THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

A Discover Gate Journey: Insights from Larry Weiss

by Colleen Kowalski on July 19, 2022

Are you prepared to work through the Value Acceleration Methodology with your business owner clients? How do you effectively lead a Triggering Event to uncover the baseline value and risks in an owner’s business?

Recently, Exit Planning Institute hosted a webinar from Larry Weiss on his journey to become a CEPA, how to implement the Value Acceleration Methodology in your business, and the importance of understanding the Triggering Event.

Meet the Presenter: Larry Weiss

Larry Weiss is committed to helping Dental Lab Owners be more successful and profitable while increasing their wealth, personal satisfaction, and free time.

Prior to Weiss Advisors, Larry has 30 years plus of C Level roles including controller, CFO, President, Regional Director of Operations, Director of Business Development, and member of an M&A team. He is most proud of his success at Keller Dental Laboratory where he built an amazing team that grew to a National Competitor with almost 250 employees producing 1,000 custom-manufactured prostheses a day.

After graduating from the University of Missouri, Larry joined PWC and spent a short stint in Banking. In the last two years, Larry was certified as an Exit Planner, a Certified Professional Business Advisor, and Re-activated his CPA License.

Throughout his career, he has presented at programs, conferences, and National meetings. Larry likes to be involved. He has served on the Cal Lab Board of Directors, National Association of Dental Laboratories Board of Directors, Board of Directors of the St. Louis Chapter of the Association for Corporate Growth, Mizzou Alumni Association, and Adjunct Faculty at St. Louis University School of Business in their Entrepreneurship program.

What is the Value Acceleration Methodology?

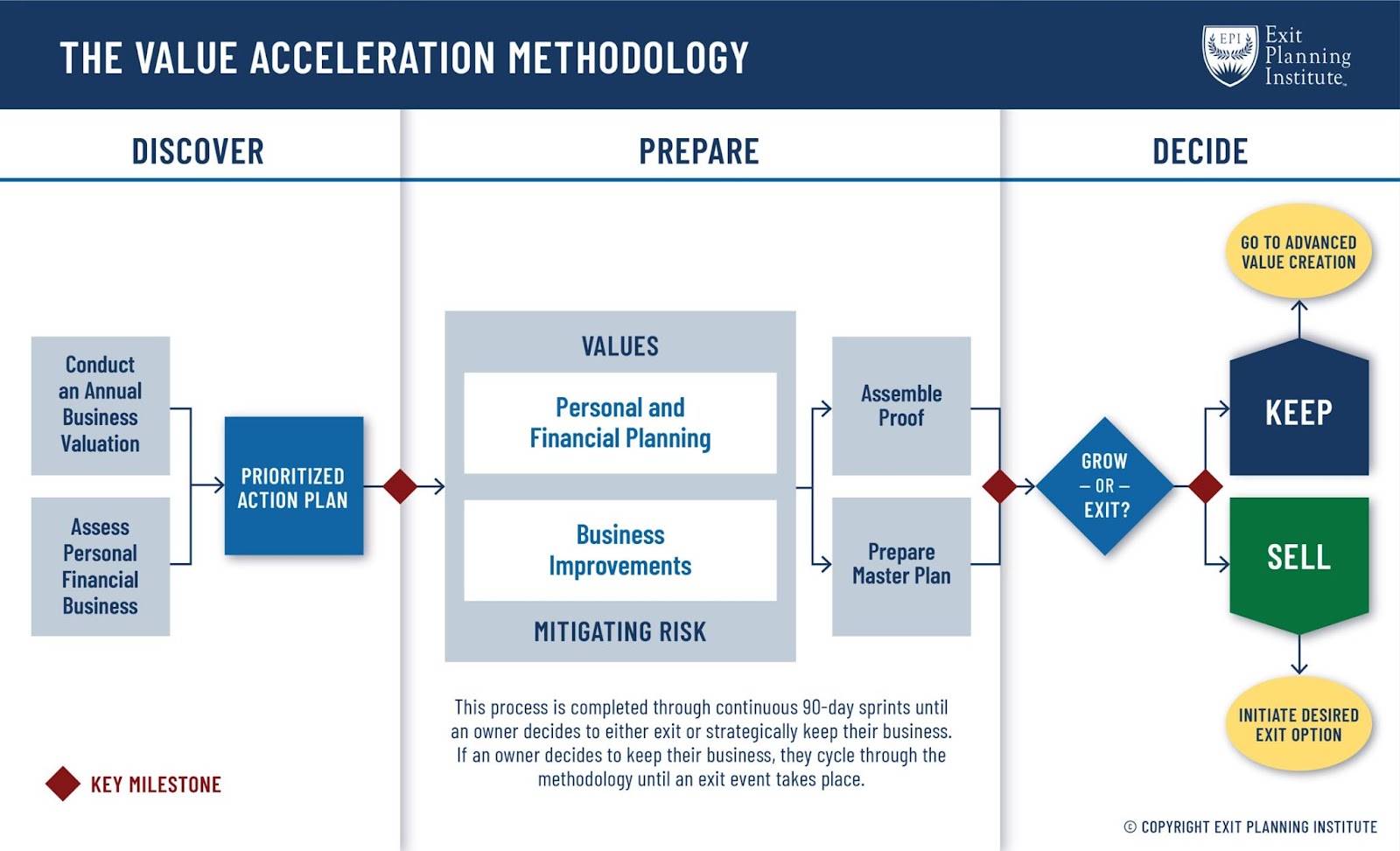

The Value Acceleration Methodology™ is your strategic framework for executing exit planning. It is the value management system that makes the timing of an exit irrelevant. Exit planning is laser-focused on what you can do right now to grow the value of the business and drive income.

By focusing the approach on building a business with characteristics that drive value and integrating the owner’s personal and financial objectives into it now, there will be many options to exit on the owner’s timeline and terms.

The Value Acceleration Methodology can be broken down into three gates. These gates are: Discover, Prepare, and Decide. Christopher Snider writes in Walking to Destiny: 11 Actions an Owner Must Take to Rapidly Grow Value & Unlock Wealth, Value Acceleration “can be used as a tool to teach your team how to create value, not just more income, measure their performance, and benchmark value creation.”

How To Begin an Owner Engagement

Larry formed his advisory practice, Weiss Advisors in 2019. He shared, “When I started this business, I assumed every owner client would be exiting. However, I learned that most of my owner clients are looking to accelerate value, successfully transition to the second or third generation, or expand their business into new markets.” In 2020, Larry successfully completed the Certified Exit Planning Advisor program and earned his CEPA credential. By incorporating the Value Acceleration Methodology into his owner engagement meeting from the beginning, Larry was able to address an owner’s business, personal, and financial goals immediately.

Larry shares that the best way to begin the exit planning conversation is to simply get started. Many owners fall into thinking that they do not have to begin exit conversations if they are not interested in exiting their business for a while, however, without proper planning for the future of their business, they could end up leaving money on the table when they ultimately decide to sell.

The Discover Gate

Exit planning is a continuous cycle of value growth, risk mitigation, and personal readiness. The first gate of the Value Acceleration Methodology, the Discover Gate, includes three key components. These are a Business Valuation, Assessment of Owner Needs, and Creation of a Prioritized Action Plan. These components collectively act as a Triggering Event to begin the owner’s exit planning process.

Larry explains that a typical Discover Gate engagement with his clients takes between 3 to 5 months. During this time, he utilizes MAUS Business Systems to complete up to five assessments on the owner’s personal wants, needs, financial goals, and business readiness and attractiveness. MAUS software provides Larry with a detailed analysis of the owner’s current revenue, EBITDA, and valuation as well as highlights what changes must be made to reach their desired valuation.

Exit Planning Institute Resources

Exit Planning Institute offers a variety of resources to professional advisors just starting their exit planning practice and those with decades of experience. Larry expresses, “Using the EPI content helped me understand the value acceleration methodology and exit planning better. After incorporating their content in my client engagements, I had an increased closure rate and more committed professional relationships.”

As a CEPA, you gain access to presentations, business development tools, and assessment materials in our Member Center. In addition to those resources, we release an in-depth whitepaper, topical case study, and detailed infographic on trending exit planning topics each quarter. Our Exit Planning Content Library provides professional advisors with information to enhance their professional relationships with business owners as well as educate owners on specific exit planning topics.

Learn more about how to utilize Exit Planning Institute content in your practice and solidify your place as your owner’s most trusted advisor.

Exit Planning Institute Webinars

EPI hosts webinars on a wide range of exit planning topics. These webinars are offered free to all advisors and owners looking to advance their knowledge on value growth, intangible capitals, the M&A market, strategic planning, and more. View our upcoming webinars from industry professionals here.

Our CEPA members can watch Larry’s webinar, and view all archived webinars in the EPI Member Center.

Follow our socials for more exit planning content and strategies.

Share this

- Blog (550)

- CEPA (433)

- exit planning (249)

- CEPA community (189)

- Business Owner (176)

- Exit Planning Summit (100)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- women in business (19)

- Intangible Capital (18)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- charitable intent (13)

- Chris Snider (12)

- National Accounts (12)

- Small business (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- DriveValue (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- Owners Forum (3)

- author (3)

- forbes (3)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Annual Exit (1)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)

Subscribe by email

RELATED ARTICLES