THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

EPI Myth Busters – High Income does not equal High Value

by Colleen Kowalski on November 4, 2020

We have all heard an owner talk about how much they make in their business and why that makes their business extremely valuable. They think their business is worth all the money in the world, because it provides them with a nice livable income. An important first step in your advisory role is to politely crush this myth.

While they may pay themselves a nice annual salary, focusing on owner income alone does not mean the company has transferable market value. Learn how to bust the myth that high income equals high business value. Improve the readiness and attractiveness of your clients’ businesses by highlighting ways to grow and protect value through strategic planning.

For a business owner to make the most out of their business exit, they must have a growth mindset. They should focus on growing their business value as much as they focus on growing profits. According to Walking to Destiny, “The only way to really change your culture and get everyone thinking the same way is to integrate value thinking into what you do every day”. Without actively working towards building value and instilling that belief in every member of the business, owners lose out on saleable business value in the future.

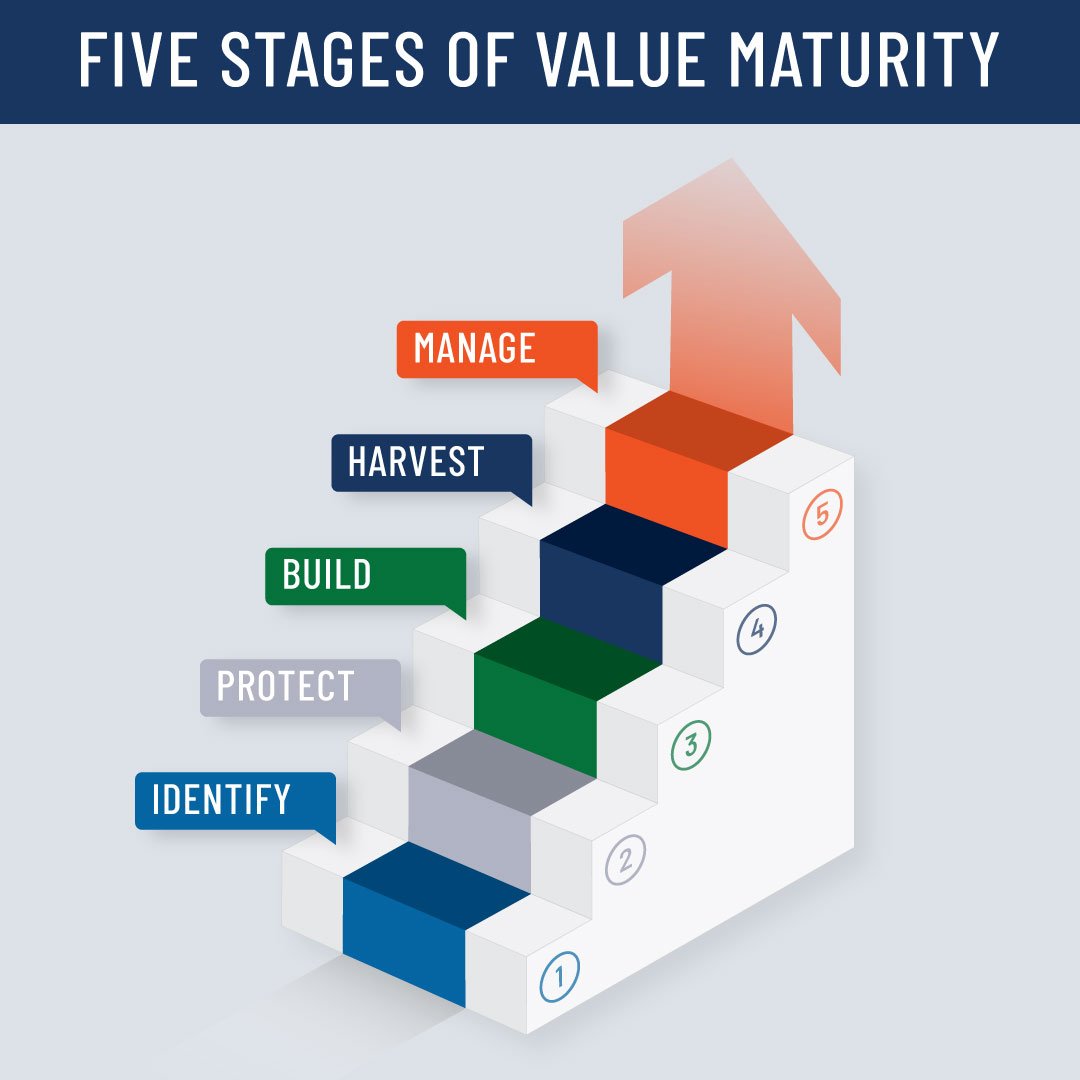

Growing business value includes mitigating risks and emphasizing business goals. Educate your owners on the Value Acceleration Methodology and provide them with the Value Maturity Index template for 90-day evaluations. If an owner fails to grow their business value, the owner decapitalizes the overall value and weakens the probability of the company’s perpetuity after they leave. Not to mention, they will pay the price for that kind of misguided strategy at the time of sale. Business valuation should be a mainstay of your financial planning. Business value is the baseline measurement of success. Without conducting a proper business valuation at least once a year, owners fail to plan for a successful financial future after they exit their company. According to Chris Snider, “Growth is key to unlocking the income trap that keeps you stuck in your business”. Fail to grow your business and you miss out on the most profitable exit.

While your business owner clients may feel like they have a good estimate on what their company is worth, it is important to educate them on the many facets of business value. Highlight how they can grow and protect this value for the most rewarding future exit.

Share this

- Blog (550)

- CEPA (433)

- exit planning (249)

- CEPA community (189)

- Business Owner (177)

- Exit Planning Summit (101)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- Intangible Capital (19)

- women in business (19)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- Small business (13)

- charitable intent (13)

- Chris Snider (12)

- National Accounts (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- DriveValue (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- Owners Forum (3)

- author (3)

- forbes (3)

- Annual Exit (2)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)

- team work (1)

Subscribe by email

RELATED ARTICLES