THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

How the Top 9% of Financial Advisors Use Data to Grow Their Client Base

by Partner Contributed Article on January 2, 2025

Using data to grow a thriving financial advisory practice requires more than great advice — it demands strategic client acquisition. Yet many advisors struggle to grow consistently, leaving a select few at the top of their game.

So, what separates the top 9% of financial advisors who consistently expand their client base from everyone else?

The answer lies in a defined marketing strategy, effective lead generation, and data-driven processes.

If that sounds like a lot of work, don’t worry, we’ll also share the best practices to implement these processes while eliminating the busywork that is commonly associated with them, pulling back the curtain on the tactics used by top-performing advisors to attract high-quality prospects, nurture them through thoughtful engagement, and convert them into loyal clients.

It’s time to learn the strategies behind the success of the industry’s most elite FAs.

The Power of a Defined Marketing Strategy

Most financial advisors are flying blind when it comes to marketing. According to the Broadridge Financial Solutions Study (2020):

- 77% of financial advisors do not have a defined marketing strategy.

- Only 23% operate with a clear plan to target prospects and grow their business (Broadridge Financial Solutions, 2020).

The impact of having a strategy is undeniable:

- 75% of advisors with a defined marketing strategy are confident they will hit their growth goals in the next 12 months.

- In contrast, only 41% of advisors without a strategy feel confident in their ability to grow (Broadridge Financial Solutions, 2020).

The top 9% of advisors understand that growth doesn’t happen by accident. They set goals, develop systems, and execute their marketing plan consistently.

What a Defined Strategy Looks Like:

1. Identifying Your Ideal Client:

Top advisors know exactly who they serve best — in the realm exit and succession planning, its business owners. By defining their target audience, they create focused, high-impact marketing that speaks directly to their clients' needs.

2. Leveraging Multiple Channels:

Successful advisors use a multi-channel approach, including:-

- Social Media Marketing: LinkedIn is a top performer, with 68% of leads sourced there (Broadridge Financial Solutions, 2020).

- Email Campaigns: Personalized, automated emails nurture leads and maintain engagement.

3. Tracking Results:

Data is the backbone of an effective strategy. Top advisors monitor key performance indicators (KPIs), including website traffic, conversion rates, and client acquisition costs, to measure success and adjust their approach.

By crafting a clear, actionable marketing strategy, advisors ensure that every effort is intentional and contributes to their overall growth goals.

Digital Marketing: A Game-Changer for Advisors

The pandemic accelerated the shift to digital, and the top 9% of advisors were quick to adapt. Broadridge’s study found that 91% of advisors agree digital marketing has become more important post-pandemic (Broadridge Financial Solutions, 2020). Despite this, many advisors face challenges:

- 86% struggle to find time for marketing.

- 86% find it difficult to select the right marketing tools (Broadridge Financial Solutions, 2020).

Top advisors overcome these challenges by leveraging tools and strategies that simplify digital marketing and maximize results such as Attract+, a done-for-you digital marketing solution built for Financial Advisors.

Key Digital Marketing Tactics Used by Top Advisors:

- Lead Magnets for High-Quality Prospects:

Lead magnets, like business performance assessments or personal readiness/retirement quizzes, attract prospects by providing immediate value. For instance, tools like ScoreYourBusiness help advisors engage business owners by offering actionable insights into their operations. - Social Media Mastery:

While more than 60% of advisors have never sourced a lead through social media, the top advisors excel at leveraging platforms like LinkedIn. LinkedIn alone accounts for 68% of social media leads (Broadridge Financial Solutions, 2020), making it a must for advisors targeting business owners.

By utilizing automated solutions, top advisors create new sales funnels that generate consistent leads with minimal manual effort.

The Prospect Pipeline: Turning Leads Into Clients

Attracting prospects is only half the battle — converting them into clients is where the real magic happens. Top advisors manage their prospect pipeline with precision, ensuring no opportunity is lost.

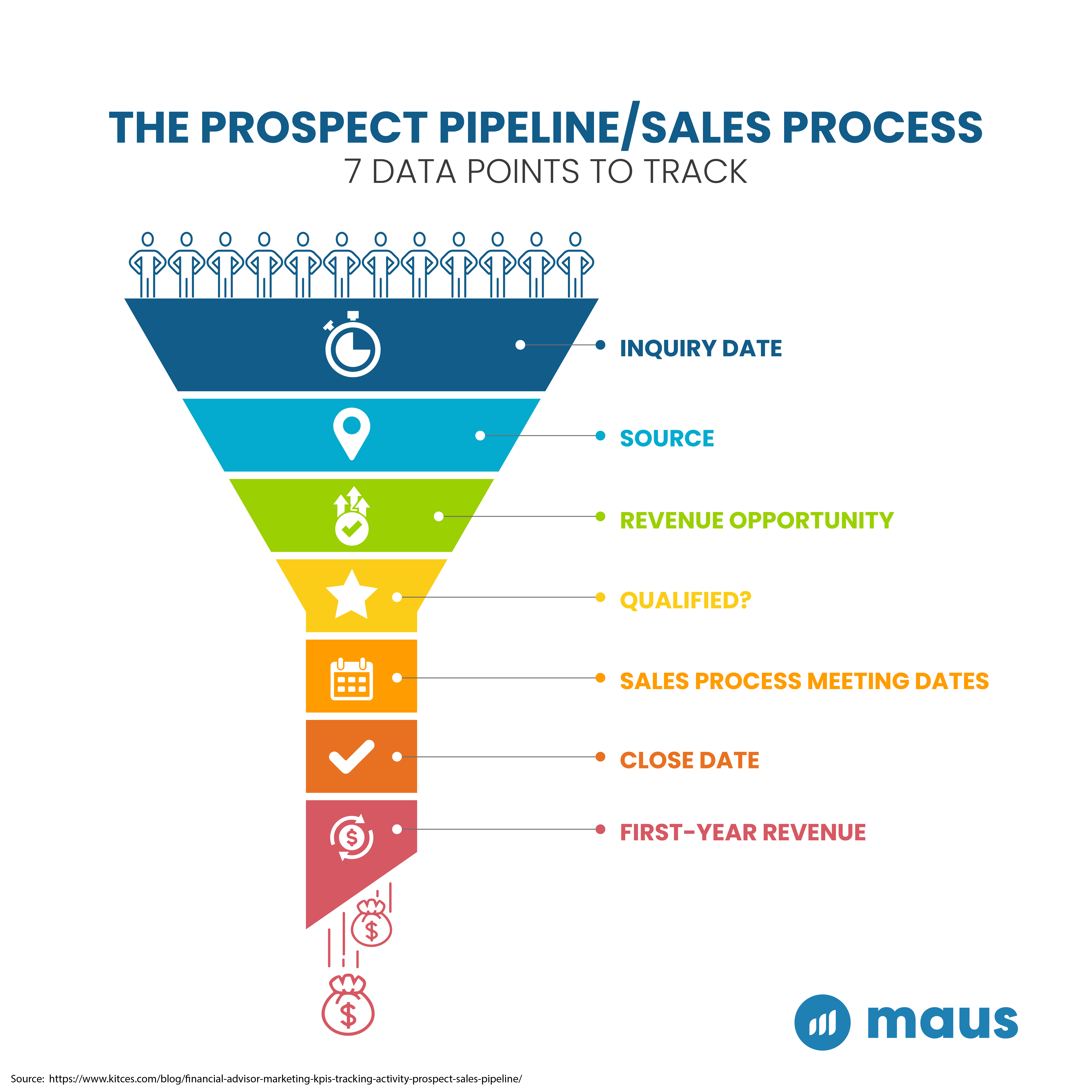

7 Key Data Points to Track

The top 9% of advisors rely on a structured process to move prospects through their sales funnel. They measure:

- Inquiry Date: When did the lead first engage?

- Source: How did they hear about you? (Referral, webinar, email, social media).

- Revenue Opportunity: What’s the financial value of the lead?

- Qualified Status: Are they a fit for your services?

- Sales Process Meeting Dates: Track key milestones in your process (intro call, proposal review).

- Close Date: When did they officially become a client?

- First-Year Revenue: What is the projected revenue from this new client?

By tracking these data points, top advisors identify bottlenecks, refine their sales process, and improve conversion rates over time (Kitces, M., 2024).

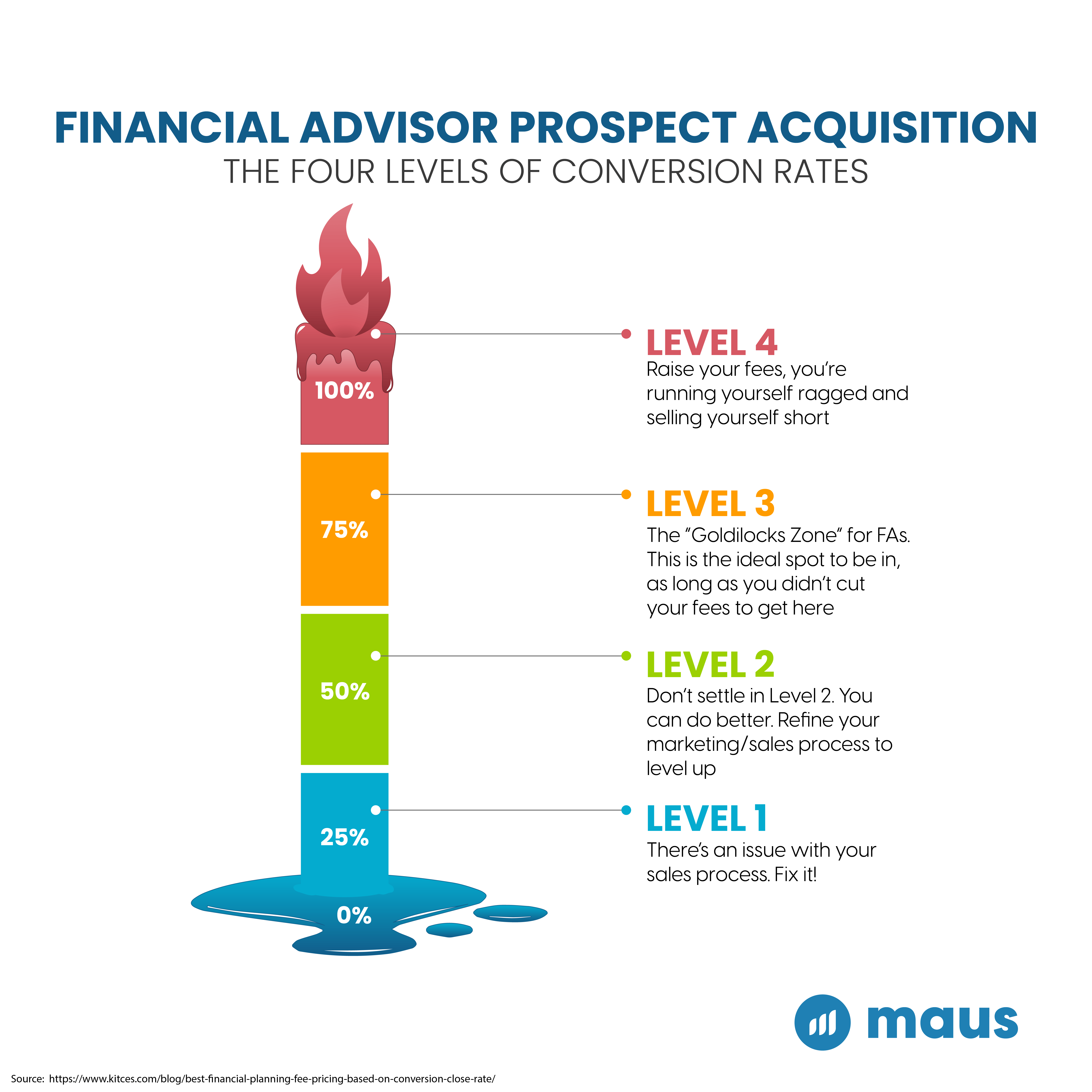

The Four Levels of Conversion

Conversion rates provide a clear benchmark for success and provide key insights into your business process, see the figure below:

- Level 1 (25%): Your sales process needs fixing—start here.

- Level 2 (50%): Decent, but there’s room to refine your approach.

- Level 3 (75%): The “Goldilocks Zone” — a strong, sustainable rate.

- Level 4 (100%): You’re likely undercharging; raise your fees (Kitces, M., 2024).

Building Long-Term Client Relationships

For top-performing advisors, acquiring a client is only the beginning. The real success lies in retaining clients, growing their value over time, and fostering trust-driven, sustainable relationships.

- Personalized Engagement

Understanding your clients on a deeper level builds trust and loyalty. Tools like Client Needs Analysis help uncover their goals, priorities, and pain points. By tailoring your solutions to address their unique challenges, you demonstrate your commitment to their success and ensure they feel heard and valued. - Ongoing Value Delivery

Consistent value delivery keeps clients engaged and strengthens your role as their trusted advisor. Tools like ValueMax automate check-ins, progress updates, and strategic insights. Since 70-80% of a business owner's net worth is tied to their business (Exit Planning Institute, 2023), staying top of mind ensures you are positioned to guide them through critical transitions, including liquidity events, and achieve their financial goals. - Focus on Referrals

Happy clients are your greatest advocates. By delivering exceptional service at every stage of the client journey, tools like Engage ensure a consistent, high-quality experience. This enhances client satisfaction, increases loyalty, and encourages referrals, driving steady, organic growth.

The Bottom Line: How to Join the Top 9%

The top 9% of financial advisors succeed because they have a plan, execute consistently, and measure their results. Here’s how you can join their ranks:

- Leverage Digital Tools: Use lead magnets, and master social media and email marketing to generate consistent, high-quality leads, and be sure to measure the success of each.

- Track Your Pipeline with a CRM: Use data to improve your sales process and boost conversion rates. Reference fig. 2 for the 4 levels of conversion rates.

- Retain and Grow Your Clients: Deliver personalized value and maintain engagement to build lasting relationships. A turn-key solutions like Attract+ by Maus Software covers all your bases without having to becoming a digital marketing expert yourself, or having to rely on the luck of the draw with flakey gig workers.

Growing your client base isn’t about luck — It’s about strategy. By implementing these proven tactics and tracking your progress, you can position yourself as a top-performing advisor and achieve measurable, sustainable growth.

Contact Maus today to learn more about how top financial advisors are using Attract+, Engage, and Build to automate their client acquisition pipeline and implement Inbound Advisory to accelerate AUM growth and improve client satisfaction.

Additional Resources:

- For more information on the benefit of becoming a Certified Exit Planning Advisor, visit The Exit Planning Institute.

- For more information about scaling AUM using software, schedule a call with a Maus Software FA expert today.

References

- Broadridge Financial Solutions. (2020). Second-Annual Financial Advisor Marketing Survey.

- Kitces, Michael. (2024). KPIs To Track Your Advisor Marketing And Figure Out What’s Actually Working (Or Not).

- The Exit Planning Institute. (2023). State of Owner Readiness Report.

*EPI believes exit planning is for all advisors, not just FA's.

Share this

- Blog (550)

- CEPA (433)

- exit planning (249)

- CEPA community (189)

- Business Owner (176)

- Exit Planning Summit (100)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- women in business (19)

- Intangible Capital (18)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- charitable intent (13)

- Chris Snider (12)

- National Accounts (12)

- Small business (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- DriveValue (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- Owners Forum (3)

- author (3)

- forbes (3)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Annual Exit (1)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)