THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

Are You Your Own Worst Nightmare in Your Business?

by Colleen Kowalski on October 13, 2023

Is there anything scarier than a Friday the 13th in October? The crisp fall air whispering through the falling leaves. A sliver of the moon peeking out behind the clouds as an owl hoots ominously in a nearby tree. It’s like a scene from a classic horror movie has come to life.

What could possibly be scarier? Losing your business because you did not plan properly for your future. As an owner, there can be many horrors lurking around every corner of your business.

On this spooky Friday the 13th, we are highlighting some of the terrors that could befall business owners if they do not implement exit planning strategies.

Owner Dependence and the Impact on Business Value

In a business that is heavily dependent on the owner for its overall success, most of the perceived business value is tied to the owner, not the business itself. One of the easiest ways to build business value, and limit the amount of time you as an owner spend working outside of traditional work hours, is to decentralize yourself from the business. If you cannot trust your second in command to manage the business while you step away for an emergency, vacation, or sick day, it is time to reevaluate your business processes.

As an owner, the best way to build value in your business is to build it as independent from your successes. Invest time and resources in training leaders in your business so they can run your business well after your exit.

Death of an Owner and the Business

The death of an owner can have a significant impact on the value of a business. After an owner’s death, there is a loss of important skills and expertise that are critical to the organization’s operations and success. This can ultimately lead to a decline in revenue, profitability, and overall value.

To ensure your business succeeds in the event of your or another owner’s death, implement a Key Person policy and have the appropriate funds available to hire someone of a similar caliber to fill the role. Create and update your Estate Plan well in advance of your exit to mitigate tax implications and legal difficulties for your family and dependents.

Incomplete Risk Mitigation

Roughly 80-90% of your net worth is locked in your business. In order to maximize your value, you need to set up a system to determine the value hidden in your business. It is difficult to plan out your next act without having a professional business valuation. Conducting an annual business valuation will help determine what value factors to focus on to accelerate the value of your business.

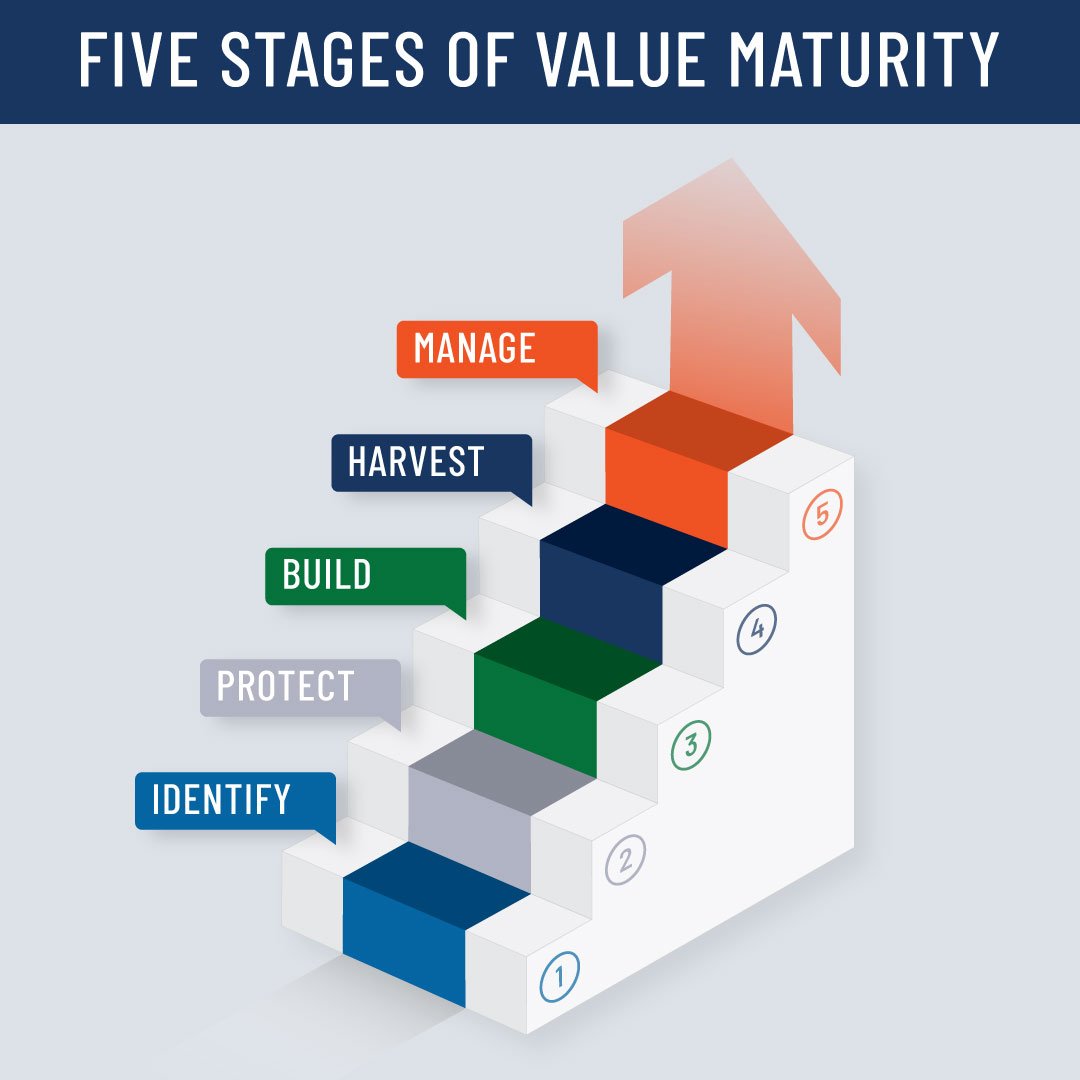

After identifying your business's baseline value, you must protect that value by mitigating any risks associated with it. Risks are divided into three categories: personal, financial, and business. According to Walking to Destiny, “protecting value is the first step in building value.”

Mismanaged Structural Capital

Structural Capital is the back-end infrastructure of the company. This includes the processes, financials, strategies, information technology, patents, and other intellectual property. It is the documented know-how and know-what of the company that positions you to be fast and flexible. Structural Capital connects people to knowledge so it can be shared to enable the business to scale.

Having the proper tools, equipment, technical resources, and intellectual property in a business is paramount to its success. Without strong structural capital, your business will be unable to function in a repeatable and scalable way. The stronger your organization’s structural capital, the more valuable your business.

When the main processes, resources, and infrastructure are well documented and organized, the business value increases as a result. The physical components of your structural capital such as your real estate, equipment, and technology, are some of the most important factors for potential buyers looking to purchase your business.

Don’t be your own worst nightmare in your business. By decentralizing yourself and improving the structural capital in your organization, your business value will increase and you will be more prepared for your eventual exit.

Learn more in our exit planning content library.

Share this

- Blog (548)

- CEPA (431)

- exit planning (249)

- CEPA community (188)

- Business Owner (175)

- Exit Planning Summit (99)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- women in business (19)

- Intangible Capital (18)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- charitable intent (13)

- Chris Snider (12)

- National Accounts (12)

- Small business (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- DriveValue (3)

- Owners Forum (3)

- author (3)

- forbes (3)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Annual Exit (1)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)