THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

EPI MythBusters – You Can Solve Issues in Your Business During the Sale Process

by pwysocki on November 18, 2020

Over the years, it is common for your businesses to develop issues. Whether the issue seriously impedes on your business or is just a small nuisance, they can often get pushed to the side to be dealt with later. During the sale process these issues have a negative impact on the value of your business or ultimately, will kill the sale all together.

Big red flags in your business can scare buyers away and ultimately become ‘deal killers.’ Because business owners can become blinded by what they believe the value of their business is, they can overlook these deal killers until it comes time to sell their business and is already too late. According to Walking to Destiny, “By simply removing risk from your personal situation, your personal finances, and your business, you increase value. Remember, any risk decreases value.” Risk and underlying issues in your business have a direct correlation to the overall value.

The truth is, buyers do not want to buy problems, they want to buy the solutions to problems. According to Entreprenuer, “Just like a home, a business must have a strong foundation to survive. Standard operating procedures, policies, and the right employees are only a few to name.” When going through the due dilligence process, buyers and their teams will actively be looking for any skeletons in the closet or warts on your business that you as the owner may be blinded to.

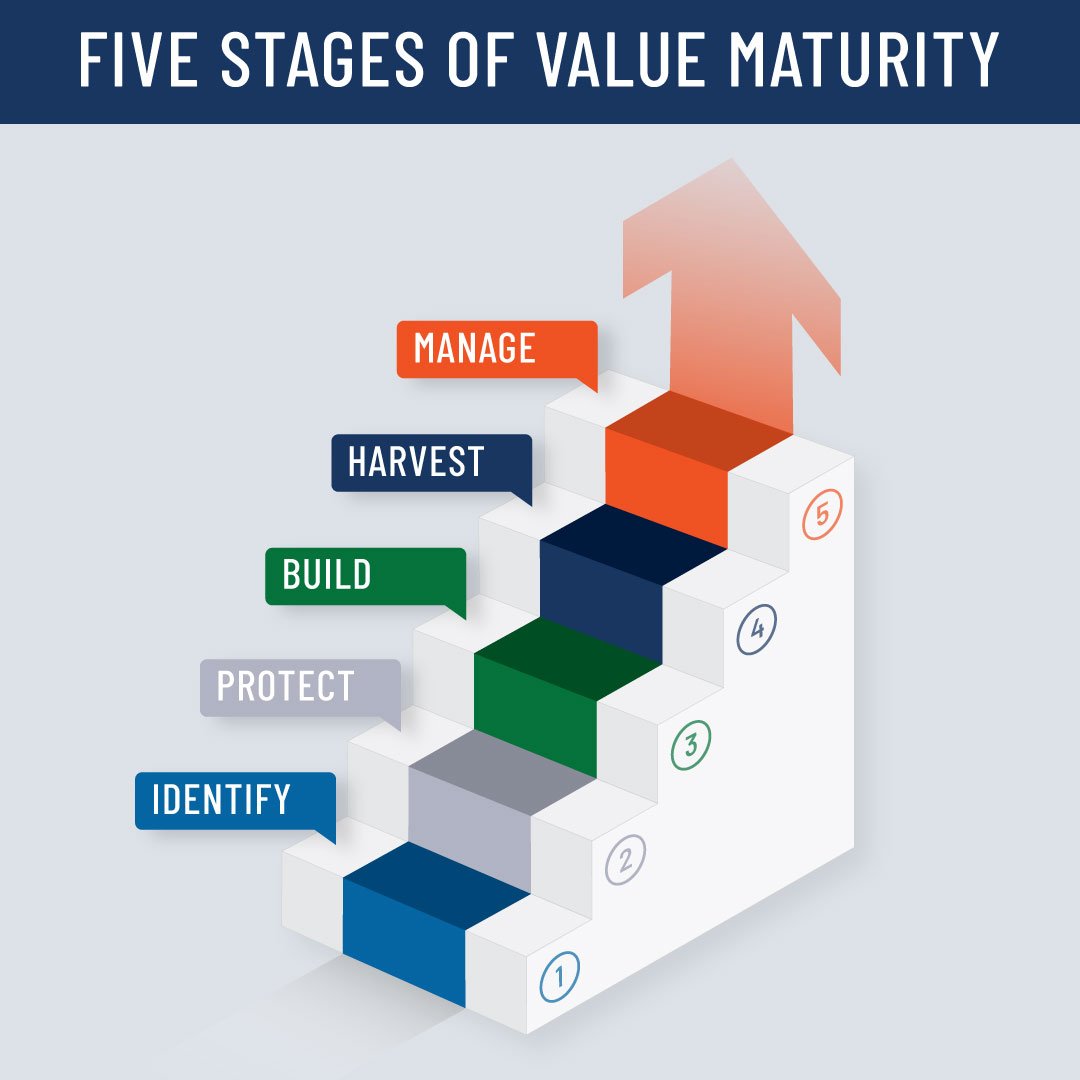

So, as an owner, how can you go about solving these issues? It starts with talking to your advisors about the Value Acceleration Methodology and derisking your business before you even begin to think about exiting your business. A CEPA provides an impartial perspective on your business and help you solve ‘deal killers’ proactively.

It can be hard to objectively see the imperfections your business may have and know how to solve them, but waiting until it is time to sell is the wrong solution. Make sure you maximize your exit options by getting the skeletons out of your closet.

Share this

- Blog (548)

- CEPA (431)

- exit planning (249)

- CEPA community (188)

- Business Owner (175)

- Exit Planning Summit (99)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- women in business (19)

- Intangible Capital (18)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- charitable intent (13)

- Chris Snider (12)

- National Accounts (12)

- Small business (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- DriveValue (3)

- Owners Forum (3)

- author (3)

- forbes (3)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Annual Exit (1)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)