THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

Creating Businesses that are Built To Sell: How to Know if You Are Ready to Sell Your Business

by Colleen Kowalski on June 28, 2021

Is Your Business a Firework?

Build Your Business with More “Substance” and Less “Flash”

We are heading into the summer season filled with fireworks for Fourth of July celebrations.

Fireworks fill the sky with beautiful colors and flashes of light, but not without extremely loud and unpleasant *boom*, *bang*, and *pop* sounds.

Can the same be said for your business? Is your company all flash and no substance? Do you have glaring issues that a potential buyer must overcome before they get to the “ooohs” and “aaahs” when they see it on the market? Your business might seem ready for market on the surface, but without properly evaluating the readiness and attractiveness of the company, no amount of “flash” is going to sell your company for the multiples you want.

Is Your Business All Flash and No Substance? – Attractiveness and Readiness

Exit Planning Institute President, Scott Snider, says, “Business owners don’t understand what drives value and therefore have an unrealistic opinion of it. And I think that is natural.” As a business owner, you are extremely tied to your business and can be too close to the situation to see the negatives. For example, you only see the “ooohs” and “aaahs” in the business. To you the loud noises are simply a part of the business and not an area for improvement that your customers need. This is where Readiness and Attractiveness Scores come into play. According to Walking To Destiny, business owners must complete personal, financial, and business assessments to produce two scores: Business Attractiveness and Exit Readiness.

Business Attractiveness:

Chris Snider writes that, “Business Attractiveness answers the question, ‘How attractive is your business in the eyes of a buyer.” A buyer could be a family member, another employee, or a third-party buyer. The Attractiveness Index has 25 questions in four categories. Each category provides a score which is averaged to come up with the overall Attractiveness Score. A score of 50% or lower indicates that your company is “discounted” and serves as a red flag for owners. A business with a score between 58%-72% is of above average attractiveness, and over 72% is considered a best-in-class business.

Scott Snider says that it is important to “Redefine what a best-in-class business is, particularly for the next generation business owner. No matter how good your metrics are, if your culture and customer engagement are low, your business value is low.” A business is not valuable based on profits alone, but the ability to sell at any moment.

Exit Readiness:

Exit Readiness asks the question, “How ready are you and the business to transition?” This index has over 20 questions in personal, business, and financial categories. Again, the results from each category are averaged to get the overall score for the index. Those businesses that score above a 72% are considered best-in-class.

Attractiveness and Readiness are not the same thing. Just because your business scored highly on the Attractiveness Index, does not mean you are personally ready to exit your business. Similarly, if you are personally ready to exit your business, it does not automatically mean your business is attractive to buyers. Chris Snider writes, “Readiness is just as important as attractiveness. I could argue that it is even more important because it also includes personal and financial readiness.”

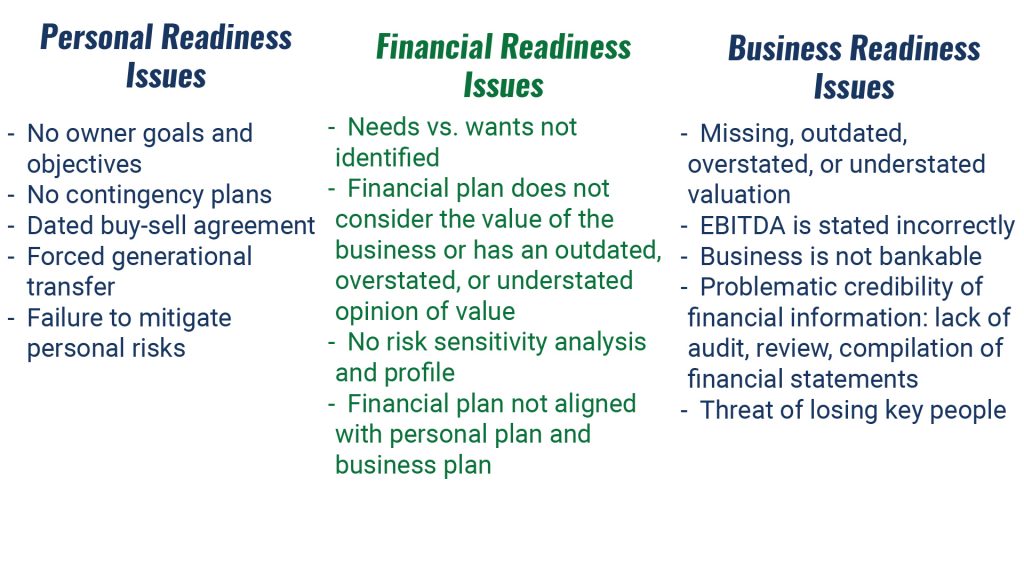

Common Business Readiness Issues – Why Businesses Don’t Sell

As we learned earlier, no matter how pretty the fireworks are, it does not mean they are without their faults. Your business could score above a 72% on the Attractiveness Index, but you are not ready personally for an exit. Are you interested to know why your business is not selling? It could be caused by any of the following common readiness issues:

There are serious consequences by attempting to transition your company if you are not personally and financially ready, let alone if your business is not ready to be sold. Selling before being fully ready for your next act will leave you feeling unfulfilled in your post-business life.

Calculating your Value Gap – How Much Money are you Leaving on the Table?

To determine what your business needs to earn in a sale, you must first determine your Value Gap. A Value Gap is the difference between what your business is worth at best-in-class multiples versus what your business currently is valued. This gap represents all the money you leave on the table without properly addressing your Attractiveness and Readiness concerns.

Building value in your business before you sell might seem like a waste of money. Why invest in something that you are going to be leaving shortly? Investing time and money into protecting and building incremental value in your business makes it more attractive to buyers. Additionally, it makes you more ready for exit. Just because your business makes a nice profit does not mean your company has the value needed to sell for the multiples you need.

How do you begin to improve your business value? Where does your company stand compared to your competitors? Learn how to build value in your business and prepare for a sale by working with a Certified Exit Planning Advisor (CEPA). Find a CEPA for your business needs.

Download our CEPA BrochureShare this

- Blog (548)

- CEPA (431)

- exit planning (249)

- CEPA community (188)

- Business Owner (175)

- Exit Planning Summit (99)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- women in business (19)

- Intangible Capital (18)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- charitable intent (13)

- Chris Snider (12)

- National Accounts (12)

- Small business (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- DriveValue (3)

- Owners Forum (3)

- author (3)

- forbes (3)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Annual Exit (1)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)