THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

Business Owners, Remember to Come Up For Air During Your Exit – The Tokyo 2020 Olympics

by Colleen Kowalski on August 3, 2021

The Tokyo 2020 Olympic Games is well underway! The Olympics, much like exit planning, encompass people from across the globe as they go for the gold. Well, in the exit of your business it is not so much “gold” as it is “money,” but the metaphor stands.

One of the most-watched Olympic sports is Swimming. Swimming has been a staple of every modern Summer Olympic Games. The United States Olympic Swim Team has many record-breakers competing in this year’s Olympic Games. Katie Ledecky is competing in her third Olympic Games this summer and already has five Olympic gold medals and one silver. She was the youngest Olympian on Team USA in 2012, when she competed, and won gold, at the London Olympics at age 15. Allison Schmitt is competing in her fourth Olympic Games and has eight Olympic medals to her name.

The United States has dominated the pool for the past two decades, winning more medals than any other country. This is in no small part because of Olympic swimming legend, Michael Phelps. Michael Phelps has the most medals in Summer Olympics history, with a record-setting 23 Gold, three Silver, and two Bronze medals from his five Olympic appearances. Phelps has retired from the Olympic competition after appearing in the Rio Olympics in 2016.

How did Phelps know he was ready to retire? Better yet, how do you know if you are ready to retire? What planning have you done to ensure that your business is the most valuable it can be when you put it on the market? Remember to come up for air while you are planning your exit, and you’ll be well on your way to the gold.

Remember to Breathe

Olympic swimmers can hold their breath underwater for a long time, but without coming up for air, they risk not only losing the race but losing their life. Most swimmers have a set rhythm of when they come up for air. For example, Katie Ledecky takes a breath every two strokes during her freestyle. Some swimmers take a breath after each stroke or after four strokes.

As a business owner, you have your own rhythm for how you conduct your business, and adding “exit planning” to the mix can disrupt that rhythm. By shifting your mindset from exit planning being a separate endeavor to being simply a good business strategy, you can breathe a sigh of relief.

Exit Planning Institute President and Forbes Business Council Member, Scott Snider, wrote in Forbes, “What most owners do not realize is that they are doing things in their company every single day that will impact their exit.” Imagine if Olympic swimmers only came up for air during the last few meters of the race. Without constantly breathing during their swim, they miss out on valuable oxygen needed to continue through their race.

Now, think about that in terms of your business. Take the time to work on your exit plan now in order to build value in your company for the future. Snider says, “By focusing on the now, you can make a greater impact on your business short term while gaining value and increasing the likelihood of a successful and fulfilling transfer in the long term.”

Stay in Your Lane: Concentrate on Your Business, Not Your Competition

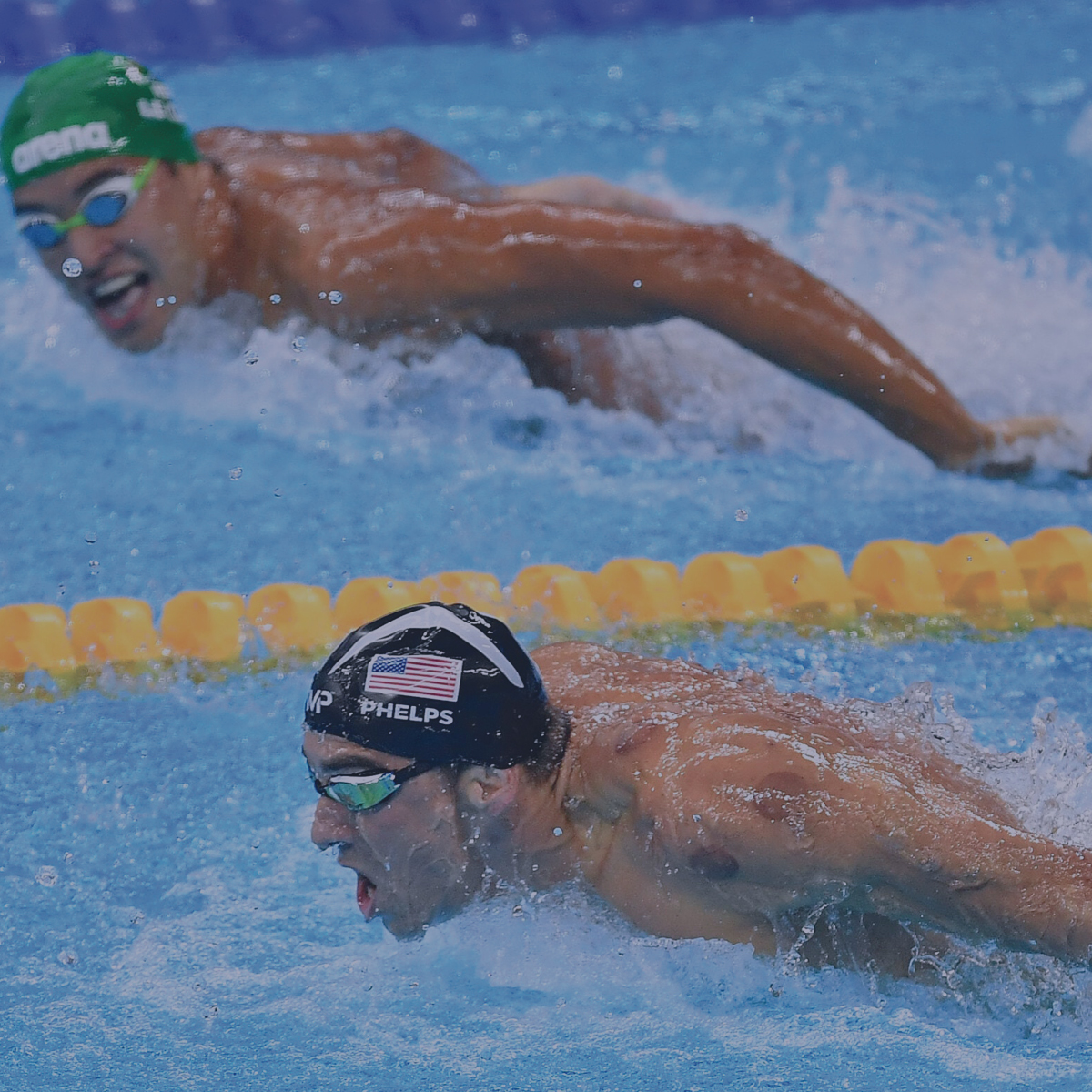

One of the most popular photos to come out of the 2016 Rio Olympic Games is of South African swimmer, Chad Le Clos looking at Michael Phelps during the final 50 meters of the 200m butterfly. While Le Clos is focused on his competition, Phelps is only focused on his goal: the Olympic gold medal. There is a time and place for analyzing your competition, but Le Clos was too focused on how his competitor was performing instead of improving his own performance.

In your business, you no doubt have competitors with whom you compare your business performance on a semi-regular basis. This can help you to improve because it is human nature to try and one-up the competition. However, focusing too much on the value of your competitors’ businesses instead of improving your own business value will not benefit you during a sale.

Competitor analysis should be used in order to determine the range of values for businesses in your industry. These values will help you to see if your business is of low, average, or best-in-class value. To determine what your business needs to earn in a sale, you must first determine your Value Gap. A Value Gap is the difference between what your business is worth at best-in-class multiples versus what your business currently is valued. This gap represents all the money you leave on the table without properly addressing your Attractiveness and Readiness concerns.

The Exit Planning Relay Team

In the Olympic Swimming competition, there are 18 events in which athletes can medal. Of those, three events are relays where four swimmers compete as a team. Each member of the relay team is responsible for swimming their best for their leg of the race. If one member of the team is not up to the speed and ability of the remaining three members, they likely are not going to win the Gold. The same goes for your advisory team.

As a business owner, you will work with a core team of advisors on your exit plan. No single advisor will conduct 100% of the exit planning work. Each member of your core team is responsible for managing a portion of your business, financial, and personal goals. An owner’s transition advisory team is an important aspect of the exit planning process. However, according to our 2019 Nebraska State Of Owner Readiness Report, when asked if owners have established a formal transition advisory team, 70.05% said no.

According to our whitepaper, A Look Inside the Unique World of Value Creation, your core team consists of a CPA, financial advisor, attorney, and value advisor or business consultant. Martha Sullivan, President of Provenance Hill Consulting, says, “Working with an owner’s team begins with a mutual understanding of each team member’s specialty.” Each of these advisors helps you to “finish the race” by establishing how you can have your most successful next act.

How CEPA Helps Owners Swim to Gold in Their Business

Swimmers go through years of training, practicing, and competing to get to Olympic-level competitions. The Certified Exit Planning Advisor (CEPA) program is the training business owners need to build sustainable value in their business. Gain insights into driving higher net profits, align your business and personal goals, and decentralize yourself from the business to gain back valuable free time.

Now is the time to educate yourself on the myriad of exit options and succession strategies for your business. Begin implementing value growth initiatives to daily operations immediately. Successful exit planning doesn’t happen overnight. Attend a CEPA program and create a game plan to cash in on the 80% of your net worth tied up in your business. You deserve it.

Learn More about how the CEPA Program benefits business owners here.

Learn More about CEPAWant updates on the exit planning industry and direct access to our latest content?

Share this

- Blog (548)

- CEPA (431)

- exit planning (249)

- CEPA community (188)

- Business Owner (175)

- Exit Planning Summit (99)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- women in business (19)

- Intangible Capital (18)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- charitable intent (13)

- Chris Snider (12)

- National Accounts (12)

- Small business (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- DriveValue (3)

- Owners Forum (3)

- author (3)

- forbes (3)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Annual Exit (1)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)