THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

Choosing Growth at the Decide Gate: Accelerating Value Beyond the Exit

by Partner Contributed Article on October 14, 2024

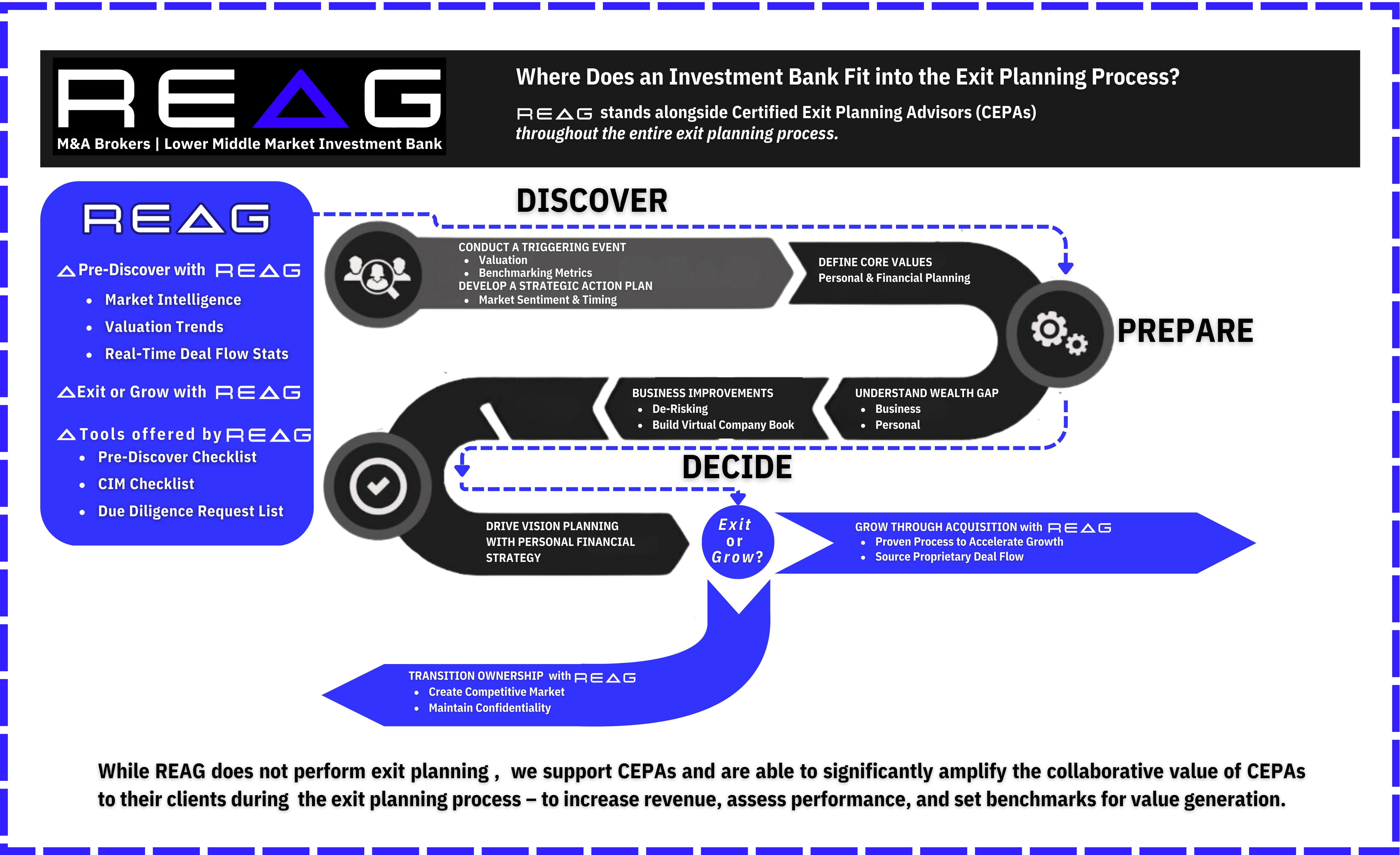

In our previous post, we explored the Sell option at the Decide Gate of the Value Acceleration Methodology. We discussed how business owners, guided by Certified Exit Planning Advisors (CEPAs), can navigate the sale of their companies with REAG as their dedicated and trusted M&A Brokers.

It is important to note: the Decide Gate isn't just about exits. For many business owners, it represents a valuable opportunity to double down on growth and take their companies to new heights.

Here, we'll delve into the Growth option at the Decide Gate and how it can lead to even greater value creation.

The Decide Gate: A Crossroads of Opportunity

The Decide Gate, as outlined in Christopher Snider's book "Walking to Destiny," represents the culmination of the Value Acceleration Methodology. It's where business owners, armed with insights from the Pre-Discover, Discover and Prepare gates, make crucial decisions about their future. While some choose to exit, others recognize untapped potential in their businesses and opt for continued growth.

Why Choose Growth?

Selecting the Growth path at the Decide Gate is a strategic decision that can yield significant benefits:

- Increased Business Value: By investing in growth, owners can substantially increase the value of their businesses, potentially leading to a more lucrative exit in the future.

- Personal Fulfillment: Many entrepreneurs find joy and purpose in growing their businesses, seeing it as an opportunity for continued challenge and achievement.

- Market Opportunities: Sometimes, market conditions or emerging opportunities make growth a more attractive option than an immediate exit.

- Legacy Building: Growth can allow owners to create a lasting impact, whether through expanded services, job creation, or community involvement.

Key Strategies for Growth in Value Acceleration

When choosing the Growth path, business owners and their CEPAs typically focus on four primary strategies:

-

Hiring Key Talent

Bringing in new skills and expertise is often the catalyst for significant growth. This might involve:

-

- Hiring experienced executives to strengthen the leadership team

- Recruiting specialists in emerging technologies or markets

- Bringing on board professionals with complementary skills to the existing team

By strategically adding talent, businesses can innovate faster, improve operations, and capitalize on new opportunities.

- Investing in Equipment

Upgrading technology and expanding facilities can dramatically increase efficiency and capacity:

-

- Implementing advanced manufacturing equipment to boost production

- Upgrading IT infrastructure to enhance productivity and data analytics capabilities

- Expanding physical facilities to accommodate growth or enter new markets

These investments, while often capital-intensive, can lead to substantial returns through increased output, improved quality, or reduced costs.

- Expanding Markets

Market expansion is a powerful growth strategy that can take several forms:

-

- Geographical expansion into new regions or countries

- Entering new market segments with existing products

- Developing new products for current or new markets

Successful market expansion requires thorough research, careful planning, and often a significant investment in marketing and sales resources. However, it can lead to diversified revenue streams and end markets reducing dependence on any single supplier, channel or industry.

- Acquisitions

Strategic acquisitions can accelerate growth and value creation:

-

- Horizontal acquisitions of competitors to increase market share and economies of scale

- Vertical acquisitions of suppliers or distributors to improve supply chain control

Acquisitions can provide immediate access to new customers, technologies, or capabilities, but they also require careful due diligence and integration planning to realize their full potential.

Implementing Growth Strategies with REAG and CEPAs

At REAG, we understand that choosing the Growth path at the Decide Gate is just the beginning. Implementing these strategies requires careful planning, execution, and ongoing support. This is where the partnership between CEPAs and REAG becomes crucial.

CEPAs, armed with REAG's experience, market intelligence and strategic insights, can help business owners:

- Assess which growth strategies align best with their personal and business goals

- Develop detailed implementation plans for chosen strategies

- Identify and mitigate potential risks associated with growth initiatives

- Monitor progress and adjust strategies as needed

REAG's Role in Supporting Growth Through Acquisition

REAG offers comprehensive buy-side advisory services tailored to the complexities of the lower middle market. Their role in supporting the Growth option includes:

Strategic Assessment and Planning

- Collaborating with clients to define clear, achievable acquisition goals and criteria

- Aligning acquisition strategies with overall business objectives (e.g., market expansion, vertical integration, technological advancement)

- Developing tailored acquisition plans that support specific growth strategies

- Providing up-to-date market data and deep industry insights to inform expansion decisions

- Offering valuable market intelligence and trend analysis

- Accessing proprietary deal flow, including off-market opportunities not available through traditional channels

- Conducting strategic market research to identify prospects aligned with client priorities

Proprietary Deal Flow

- Leveraging REAG's extensive network to uncover exclusive acquisition opportunities

- Implementing a proven process to maximize proprietary deal flow

- Providing clients access to unique, off-market deals that align with their strategic goals

- Utilizing REAG's 20+ years of industry connections to source potential targets before they hit the open market

Target Identification and Outreach

- Implementing consistent, targeted outreach to potential acquisition targets

- Engaging with candidates that match specific criteria and objectives

- Leveraging 20+ years of dealmaking experience to guide strategic acquisitions

Due Diligence and Deal Structuring

- Assisting with comprehensive due diligence processes focused on critical aspects impacting client objectives

- Structuring deals that maximize value, minimize risk, and achieve specific objectives

- Offering both traditional and creative solutions to navigate complex situations

Negotiation and Deal Closure

- Prioritizing client interests throughout the negotiation process

- Crafting deals that address key priorities such as talent retention and integration planning

- Ensuring critical objectives are protected and realized in the final agreement

Risk Mitigation and Integration Planning

- Identifying and addressing potential risks throughout the acquisition process

- Providing guidance on post-acquisition integration strategies

Ongoing Support and Communication

- Maintaining concise, transparent, and consistent communication with all stakeholders

- Offering flexibility to adapt approaches based on client needs (strategic buyers, financial buyers, etc.)

- Executing a proven, yet fluid process to maximize deal flow and achieve winning outcomes

Balancing Growth and Exit Planning

It's important to note that choosing Growth at the Decide Gate doesn't mean abandoning exit planning altogether. In fact, the Value Acceleration Methodology emphasizes that exit planning is an ongoing process, regardless of the immediate path chosen.

By focusing on growth, owners are essentially working to create a more valuable business, which in turn provides more options for an eventual exit. This approach aligns perfectly with the core principle of the Value Acceleration Methodology: building a business with characteristics that drive value, while integrating the owner's personal and financial objectives.

Choosing Growth as a Path to Value

The Growth option at the Decide Gate represents a powerful opportunity for business owners to take their companies to new levels of success and value. By leveraging strategies such as hiring key talent, investing in equipment, expanding markets, and pursuing acquisitions, owners can create thriving enterprises that generate increased wealth and provide expanded exit options in the future.

With the support of REAG, CEPAs and their business owner clients can navigate the complexities of growth with confidence, making informed decisions that align with their long-term objectives. REAG's strength lies in its flexibility and ability to adapt to diverse client needs:

- For strategic buyers, REAG maximizes synergies to drive value creation.

- For financial buyers, REAG optimizes returns to meet investment goals.

- For clients with unique needs, REAG tailors its approach to address specific challenges and opportunities.

This adaptability ensures that whether the ultimate goal is a more lucrative exit, a larger market impact, or the creation of a lasting legacy, REAG can guide clients along the Growth path that best suits their vision of success. By leveraging REAG's expertise and flexible strategies, businesses can pursue acquisitions and growth initiatives that directly contribute to their long-term aspirations, creating a compelling route to achieving their goals in the ever-evolving business landscape.

Remember, the focus is always on building value today, regardless of when you plan to exit. By choosing Growth with REAG at the Decide Gate, you're not just postponing an exit – you're actively working to create a more valuable, impactful business for whatever the future may hold.

If you are ready to unlock the unrealized value of your company, reach out and let’s begin together.

Related Resources:

Share this

- Blog (547)

- CEPA (429)

- exit planning (249)

- CEPA community (188)

- Business Owner (173)

- Exit Planning Summit (99)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- women in business (19)

- Intangible Capital (18)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- Chris Snider (12)

- National Accounts (12)

- Small business (12)

- charitable intent (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- Owners Forum (3)

- author (3)

- forbes (3)

- DriveValue (2)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Annual Exit (1)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)