THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

Marketing Your CEPA Offering: How to Turn Your Credential into a Scalable Exit Planning Business

by Maus Software on July 14, 2025

If you’ve earned your Certified Exit Planning Advisor (CEPA®) designation you already know the value of exit planning, not just for your clients, but for your career. The question is: how do you take that certification and turn it into a scalable, revenue-generating practice?

At the 2025 Exit Planning Summit, Michael Brady, CEPA and Director of Sales at Maus Software, presented a streamlined roadmap to help financial advisors commercialize their CEPA designation. Whether you’re just starting or expanding your practice, this article summarizes key insights on building, marketing, and systematizing your offering for long-term success.

Why Most CEPAs Struggle to Get Started

Let’s start with the elephant in the room: Most CEPAs never fully commercialize their designation. Why?

- Lack of awareness: Many advisors struggle to explain exit planning or how it relates to their existing services.

- No offer: Advisors often don’t know how to structure or price their services.

- Limited systems: Without the right tools, it’s hard to scale or measure success.

- Marketing overwhelms: Even experienced advisors feel stuck when trying to consistently attract and engage business owners.

Don’t go at it alone. You don’t need to reinvent the wheel; you need a proven process.

Step 1: Go-to-Market with a Clear Offer

Before you can scale, you need to know what you're selling.

Use this simple three-phase framework to design your CEPA-based offering:

Phase 1: Discovery

Start with a conversation. Understand the business owner's goals, fears, and timeline. Use digital assessments to gauge readiness and start building a baseline. During discovery is often when a specific pain point or milestone like an unsolicited offer, leadership change, or upcoming retirement is identified. This is your entry point to initiate the exit planning conversation, known as the Triggering Event.

Phase 2: Assessment

Systematically identify gaps using automated tools. Evaluate areas like business attractiveness, value drivers, and shareholder readiness. These assessments provide immediate value and position you as the lead advisor. Automate this process using software, like Maus, that lets clients complete assessments online, while you receive detailed reports instantly.

Phase 3: Action Plans

Deliver a roadmap that outlines the exit planning process. Break the work into manageable 90-day sprints focused on increasing business value and bridging the wealth gap. This is easily done with the right exit planning software, wherein the assessments from Phase 2 are converted into the client’s action plan strategy

Pro Tip: You don’t need to do it all. Select from an “offering buffet” like that provided in Maus to determine what you will and won’t provide. Stick to your strengths and build partnerships around the rest.

Step 2: Price It Right, And Don’t Overthink It

One of the most common blocks advisors face is pricing. The best way to start?

- Determine your hourly rate.

- Track your time.

- Do the math.

- Practice on a friend.

- Iterate.

Remember: messy action beats perfect planning. The sooner you get your hands dirty, the faster you’ll refine your offer.

Step 3: Use Tech to Formalize the Triggering Event

The "Triggering Event" is when a business owner realizes they need help, often following a valuation, life event, or internal challenge. Business owners are reactive. Your job is to create proactive engagement by formalizing the Triggering Event. Technology can help, though you must be ready to act quickly. Remember, you are the expert now.

With tools like Maus Software, you can:

- Send a digital assessment via email.

- Receive an automated report.

- Review the insights in a discovery meeting.

- Establish a follow-up plan with system-generated milestones.

This process isn’t just efficient; with the right system in place, you create a feedback loop of engagement that builds trust and urgency without requiring endless manual input.

Step 4: Automate the Prepare Gate

Once a business owner decides to move forward, they enter the "Prepare Gate,” the most critical (and time-consuming) phase of exit planning.

It is highly recommended to systematize the process with:

- Automated assessments that track client progress.

- 90-day sprints to deliver incremental wins.

- Visual dashboards to show movement over time.

- Clear reporting tools for accountability.

Using software to automate these steps saves time and delivers a consistent experience for every client at scale.

Step 5: Create a Sales and Marketing Engine

Even the best offer won’t work without a way to attract and convert business owner clients. Here’s a simple three-part framework:

- Attract

Create or utilize done-for-you solutions that speak to the pain points of business owners.

- Content marketing: Publish blogs, LinkedIn posts, and videos that educate owners on value gaps and exit readiness.

- Lead magnets: Create a “Score Your Business” self-assessment that gets shared via social and email.

- Email nurture: Develop a 6–12 email drip sequence walking through the three phases of your CEPA process.

- Webinars: Host online sessions to share frameworks and showcase your expertise.

Tools like Maus’ Attract Social automate much of this process, helping you stay top-of-mind with business owners while you focus on what you do best: advising.

- Engage

Don’t just attract eyeballs. Build relationships and cultivate engagement.

- Use assessments, quizzes (like “Score Your Business”)

- Offer a low-commitment discovery call (15–20 minutes) framed as a Readiness Chat. Use structured questions during your call that are based on the Value Acceleration Methodology™.

- Conduct webinars to draw prospects into conversations. A common conversion rate from a webinar or workshop attendee to a closed/won client is about 20%.

Done right, this system turns inbound leads into long-term engagements that grow your book of business and AUM. Exit planning is the ultimate gateway to asset management. Through this process:

- You become the trusted advisor for managing post-sale liquidity.

- You help with wealth transfer, estate planning, and insurance.

- You strengthen relationships with the next generation for multi-generational wealth management.

By aligning exit planning with AUM goals, you create continuity in the client lifecycle and protect your book of business from attrition.

Step 6: Don’t Go It Alone

One of the biggest problems CEPAs face? They feel alone at the Discover Gate.

Don’t try to reinvent the wheel. Partner with platforms and communities that specialize in CEPA success. Tools like Maus provide the entire Advisory Lifecycle Platform, so you can scale your offering without becoming a full-time marketer or project manager.

Addressing Two Common Advisor Profiles

There are two common CEPA profiles, both with unique needs:

- The New CEPA:

- Just starting out

- Limited resources

- Focused skillset

- No formal marketing

For new CEPAs, the focus should be on launching a minimum viable offer, getting your hands dirty, and leaning into automation.

- The Established Advisor:

- Already has a book of business

- Wants to expand offerings

- Needs help with systems and marketing

For these advisors, the challenge is to integrate CEPA into their current structure without overwhelming operations. With the right tech stack, systems that seamlessly integrate with the Value Acceleration Methodology and are SOC2 Type2 compliant, integration becomes seamless.

Exit Planning Is a Long Game, Make It Scalable

Here’s the hard truth: You can’t scale one-off engagements or ad hoc consulting.

But you can scale:

- Discovery assessments

- Repeatable 90-day value enhancement sprints

- Automated reports and action plans

- A CRM-integrated marketing engine

This is the difference between a high-effort consulting gig and a sustainable exit planning business.

Learn: How Exit Planning Grows AUM For Financial Advisors

Final Thoughts: The Power of Structure

In Michael Brady’s words, “Maus gives CEPAs the infrastructure they need to confidently go to market and deliver value from day one.”

But more than that, the system helps advisors stay focused on their highest-value activities:

- Deep client relationships

- Strategic planning

- Managing wealth post-exit

By using technology to automate what doesn’t need to be manual, you free yourself to do the work that really matters, and that gets rewarded.

Learn: How the Top 9% of Financial Advisors Use Data to Grow Their Client Base

Want to Learn More?

Michael Brady and the team at Maus Software have built the only exit planning platform designed to align seamlessly with the CEPA designation and the Value Acceleration Methodology.

If you’re ready to launch or scale your CEPA offering, explore how Maus can support your journey.

We’re here to help, schedule a call today.

*Exit Planning Institute believes exit planning is for all advisors, not just FAs.

Related Resources:

- Multiples Don’t Matter: How Financial Advisors Can Manage Owner’s Expectations

- Behind the Numbers: How Exit Planning Grows AUM For Financial Advisors

- About the EPI Partner Network

Share this

- Blog (550)

- CEPA (433)

- exit planning (249)

- CEPA community (189)

- Business Owner (177)

- Exit Planning Summit (101)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

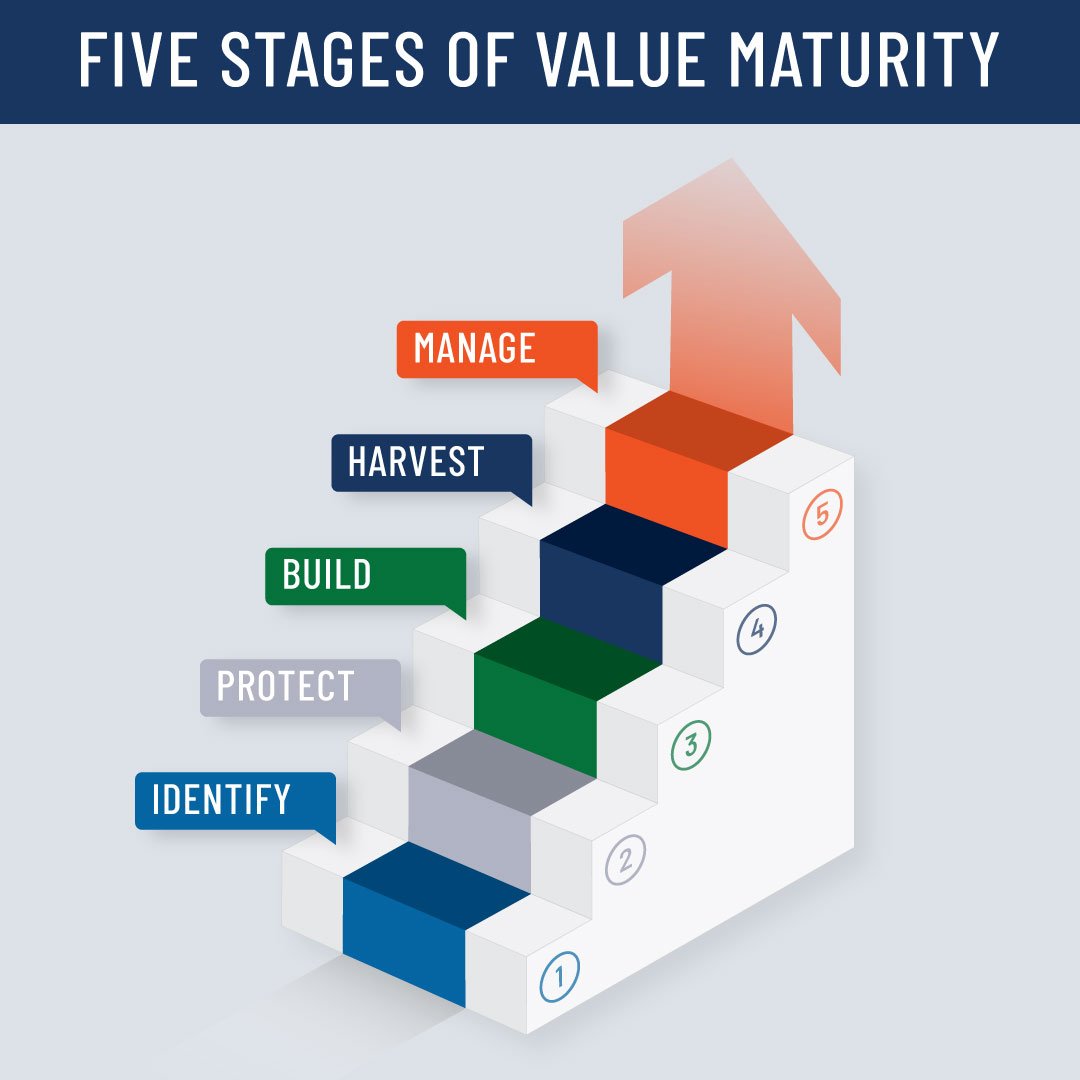

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- Intangible Capital (19)

- women in business (19)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- Small business (13)

- charitable intent (13)

- Chris Snider (12)

- National Accounts (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- DriveValue (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- Owners Forum (3)

- author (3)

- forbes (3)

- Annual Exit (2)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)

- team work (1)