THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

The Discover Gate of the Value Acceleration Methodology

by Colleen Kowalski on July 12, 2022

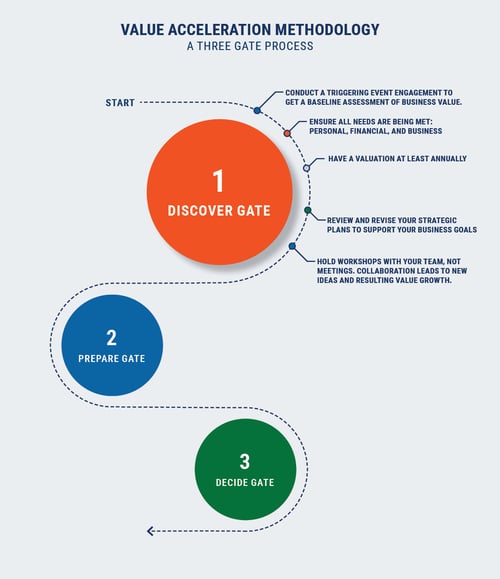

The Value Acceleration Methodology is the backbone of exit planning. This framework focuses on aligning an owner’s business, personal, and financial goals equally. All three elements build upon each other, thus moving us from very successful business owners to very significant business owners.

The Value Acceleration Methodology can be broken down into three gates. These gates are: Discover, Prepare, and Decide. Christopher Snider writes in Walking to Destiny: 11 Actions an Owner Must Take to Rapidly Grow Value & Unlock Wealth, Value Acceleration “can be used as a tool to teach your team how to create value, not just more income, measure their performance, and benchmark value creation.”

Why Use the Value Acceleration Methodology?

An owner must address three things to successfully transition their business. They must maximize transferable business value, prepare financially for a lifestyle without the income from the business, and plan personally for what they will do in their next act after exiting this business.

The Value Acceleration Methodology combines the plan, concept, effort, and process into a clear strategy to build a business that is both valuable and transferable. Chris Snider shares, “Value acceleration actions require tireless commitment and relentless execution. Exit planning is simply good business strategy integrated with your personal and financial goals and objectives.”

The Discover Gate

The first gate of the Value Acceleration Methodology, the Discover Gate, includes three key components. These are a Business Valuation, Assessment of Owner Needs, and Creation of a Prioritized Action Plan. These components collectively act as a Triggering Event to begin the owner’s exit planning process.

The Triggering Event

The first step in the Value Acceleration Methodology is to identify what an owner already has. This provides a baseline measurement of business value. This is called the “Triggering Event” and is needed for business planning, tax and estate planning, and personal planning.

Well-advised Owners rely on the facts that a formal business valuation produces describing the value of their business versus relying on hearsay and comparing their business to others. We encourage business owners to have an independent professional advisor reassess their business value annually, at a minimum.

Sam Messina, Director of Business Development at Paramax Corporation, shares that it is important for business owners to, “Have a good understanding of their advisory firm’s process and their ability to apply it to your business and your situation. Ask questions and have them walk through what they do to maximize value, including price, terms, and other important intangibles. Also, be sure you understand the projected time frame they expect it will take and how much time and effort will be expected of you and your team to assist in a successful outcome.”

The lack of formal business valuations in many cases is a major reason why so few businesses that go to market sell. According to the Alliance of Mergers and Acquisitions Advisors, 95 percent of mergers and acquisitions professionals indicated that the owner’s overestimation of value was the number-one factor in failed deals.

Business Valuations

Rick Feltenberger, a Value Advisor at ForwardFocus, shares, “At ForwardFocus, we conduct an annual business valuation prior to our Strategy Retreat. We view the business valuation as the Gold Standard for determining if we have really made improvements toward becoming a significant business. Additionally, it helps the executive leadership team in their personal and financial planning by establishing an agreed-to Value of the business.”

Julie Keyes, Founder and CEO of KeyeStrategies, says, “It’s essential to learn the actual value of your business today. Usually, the owner believes the value to be higher than it is. Owners must determine whether a gap exists in the value between what the business is worth and what they need to maintain their lifestyle after exit. It’s essential to learn the actual value today.”

Recent EPI research found that of those owners who have written transition plans, 43% include a business valuation as a part of their overall strategy. Justin Goodbread states, “A valuation puts your business’s strengths and weaknesses front and center. What’s truly valuable about this is that it enables you to then take action to improve the areas that are lacking.”

Personal, Financial, and Business Planning Assessment

Creating and maintaining updated Personal Financial Plans, estate plans, and tax plans are important for one’s personal financial strategy and mitigation of personal financial risk. Through this assessment owners determine their attractiveness and readiness for a business exit.

Julie Keyes shares, “Everything I do in my business is driven by my personal, financial, and business goals. There’s a purpose for everything on the plan and all objectives are tied to the bigger picture goals. ROI, as well as ROT (Return on Time), are essential in measuring effectiveness.”

At ForwardFocus, Rick Feltenberger incorporates his Executive Leadership Team in all discussions about business needs. He states, “All members of the Executive Leadership Team are required to meet with their wealth/risk/estate advisors to review their personal and financial plan prior to our Strategic Retreat. By developing a Life After Business Plan and a solid financial plan to fund it, each member of the Executive Leadership Team is prepared for the expected, the unexpected, and the inevitable. Our business goals are designed to support those Life After Business Plans.”

Create Prioritized Action Plan

Julie Keyes stresses the importance of a strong strategic action plan when moving through the Value Acceleration Methodology. She says, “Value Acceleration is just a good business strategy. The ugly truth is that most business owners have never created or implemented a solid Strategic Plan. Regardless of what stage the business is in, the owner should always be looking to grow value and be ready for opportunity when it knocks. Every quarter I revise the Strategic Plan Short Term Objectives that support the longer-term goals for my own company, KeyeStrategies, as well as for my clients.”

Business owners and advisors can move through the Prioritized Action Plan process in different ways. Justin Goodbread identifies weaker areas in his business as well as opportunities to capitalize on through benchmark assessments and SWOT analysis.

Justin shares, “We’ll typically begin that process at the beginning of the year, then choose three objectives from our findings. Once we’ve chosen our objectives, we gather the entire team, off-site, for a 3-4 day retreat. During this time, we map out our strategies for the year, including prioritized action plans. Oftentimes, we use these action plans as a means of accomplishing the objectives in our annual strategic plans.”

How Do I Incorporate This in My Company?

- Conduct a Triggering Event to get a baseline assessment of business value.

- Ensure all needs are being met: personal, financial, and business

- Have a valuation at least annually

- Review and revise your Strategic Plans to support your business goals

- Hold workshops with your team, not meetings. Collaboration leads to new ideas and resulting value growth.

Learn more about the Three Gates of the Value Acceleration Methodology in our whitepaper, “From Successful to Significant: The Framework for a High Value Business Transition.”

Share this

- Blog (550)

- CEPA (433)

- exit planning (249)

- CEPA community (189)

- Business Owner (177)

- Exit Planning Summit (101)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- Intangible Capital (19)

- women in business (19)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- Small business (13)

- charitable intent (13)

- Chris Snider (12)

- National Accounts (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- DriveValue (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- Owners Forum (3)

- author (3)

- forbes (3)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Annual Exit (1)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)

- team work (1)