THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

The Prepare Gate of the Value Acceleration Methodology

by Colleen Kowalski on July 21, 2022

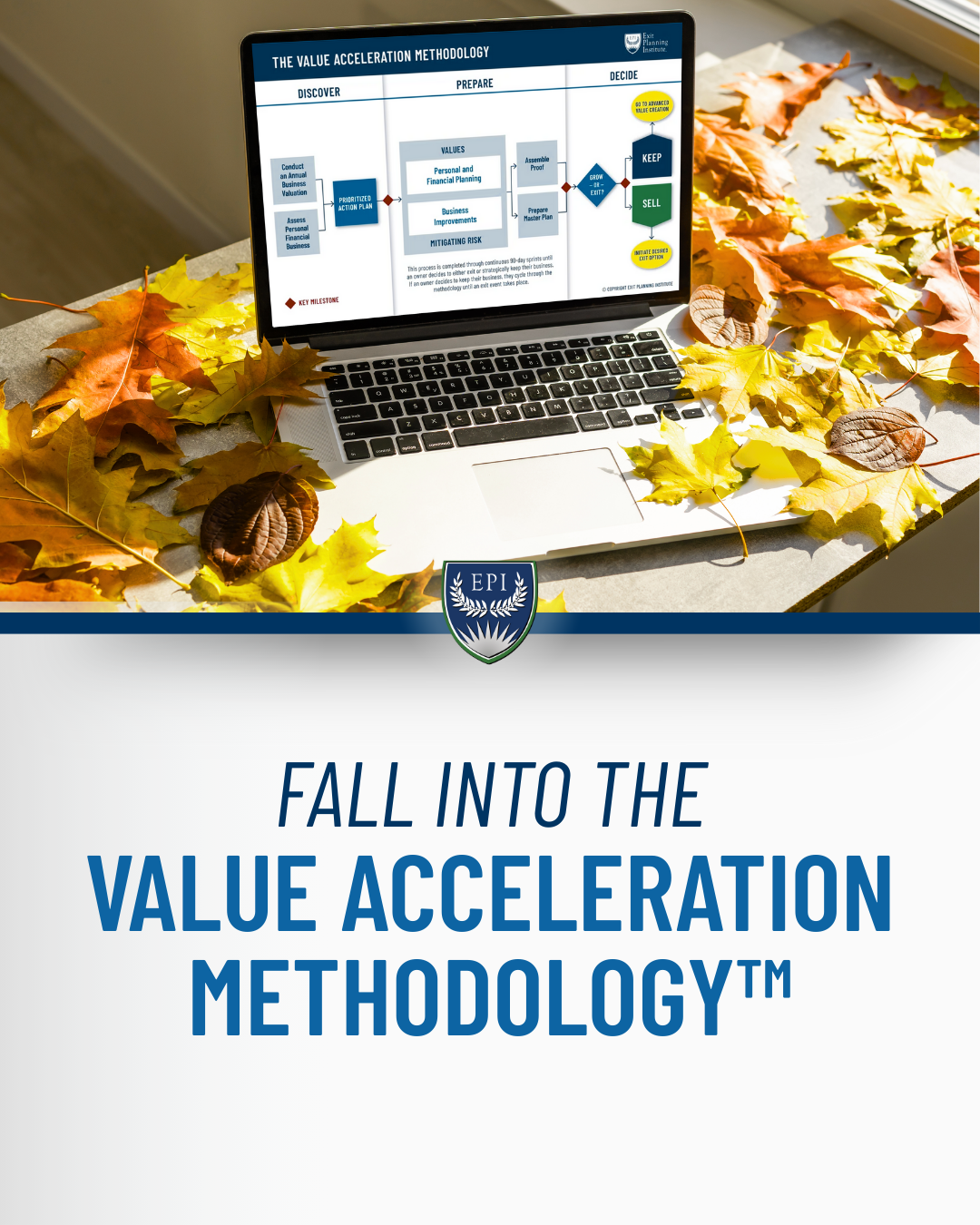

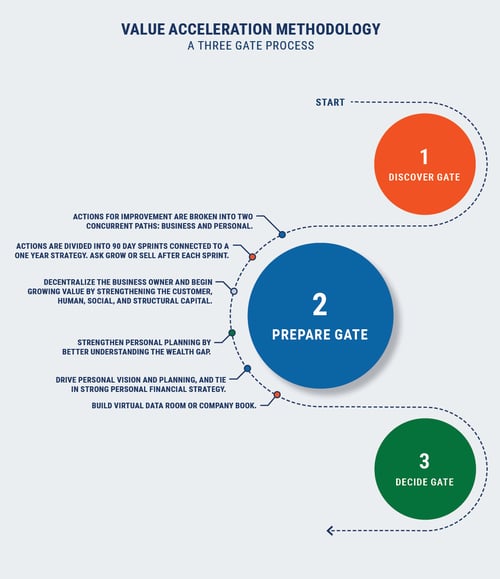

The Value Acceleration Methodology is the backbone of exit planning. This framework focuses on aligning an owner’s business, personal, and financial goals equally. All three elements build upon each other, thus moving us from very successful business owners to very significant business owners.

The Value Acceleration Methodology can be broken down into three gates. These gates are: Discover, Prepare, and Decide. Christopher Snider writes in Walking to Destiny: 11 Actions an Owner Must Take to Rapidly Grow Value & Unlock Wealth, Value Acceleration “can be used as a tool to teach your team how to create value, not just more income, measure their performance, and benchmark value creation.”

Why Use the Value Acceleration Methodology?

To successfully transition their business, an owner must address three things. They must maximize transferable business value, prepare financially for a lifestyle without the income from the business, and plan personally for what they will do in their next act after exiting this business.

The Value Acceleration Methodology combines the plan, concept, effort, and process into a clear strategy to build a business that is both valuable and transferable. Chris Snider shares, “Value acceleration actions require tireless commitment and relentless execution. Exit planning is simply good business strategy integrated with your personal and financial goals and objectives.”

The Prepare Gate

By the time an owner gets to gate two of the Value Acceleration Methodology, they have established their vision for their company. They have a plan put together and action items to complete to build value in their organizations. The Prepare Gate is about executing those action items. Chris Snider writes in Walking to Destiny, “Delivering action is about focus, reinforcement, and accountability. One of the keys is moderation; do not overload yourself or your team. Take big projects and break them down into 90-day incremental deliverables.”

During the Prepare Gate, business owners and advisors work to strengthen the business values and mitigate risks by making strategic improvements. These actions serve as proof that value-building systems are in place and help owners reach their desired personal, business, and personal financial goals.

How Your Values Impact Your Business

Justin Goodbread shares, “It doesn’t matter how good your business is. There are always going to be areas that can improve. Even as you work to improve certain areas, others will move in response. So, each time I’ve gone through the Value Acceleration Methodology, it has revealed new improvements that can be made. These improvements could be as simple as updating our business plan to reflect current financial projections. Other times, they’ve been drastic improvements, such as aligning our sales and marketing teams’ efforts, so they operate more efficiently, together.”

When owners work with their teams in monthly, quarterly, and yearly workshops, not only will the intangible capitals in their business strengthen, but their business value grows as well. Jennifer Ramos shares she plans for three years, annual, and monthly goals, and reassesses these goals every 90 days. “I look at these targets monthly and take them on 90 days sprints. At this point, I look back 90 days and determine if my action plan needs updating or is strong and right on target.”

Mitigating Risk in Your Business

The Prepare Gate provides owners with the time to uncover and mitigate risks in their business. Rick Feltenberger and Jennifer Ramos share that they both assess the risks in their business by looking into the strengths and weaknesses of their intangible capitals. According to Walking to Destiny, “By simply removing risk from your personal situation, your personal finances, and your business, you increase value. Remember, any risk decreases value.” Risk and underlying issues in your business have a direct correlation to the overall value.

Matthew Barber consults with industry experts to compare business risks. He shares, “We do an annual assessment to help identify problem or opportunity areas. Discussing with other industry experts as the landscape changes for every business helps to identify risks that previously did not exist before as well. If you focus on increasing the value of the company, you’re likely de-risking and implementing improvements that optimize operations which in turn improve the bottom line.”

Julie Keyes assesses risks in her business by examining how the Five Ds (divorce, disagreement, disability, death, and distress) would impact her business if any one of them occurred today. She shares, “By examining the 5 Ds with the help of the leadership team, we can then implement risk mitigation from there based on findings. We employ the assistance of outside professionals like attorneys, IT Service providers, HR professionals, Operational systems and procedural experts, and other experienced advisors.”

Owner-Dependent Businesses

Melisa Silverman, the Managing Partner at Founders Group, says that owner-dependent businesses often lack well-documented processes and strategies because the owner was the only one to manage specific aspects of the business. Without detailed business processes, a company not only is unprepared for the market but is missing out on valuable time-saving systems as well.

In most cases, owner-dependent businesses have strong customer relationships. Unfortunately, those relationships are between the customer and the owner specifically. This means that if and when the owner exits the business, these customers have a high chance of terminating their relationship with the business as well. So while the customer base may seem strong, in reality, the strength of the company’s customer capital is quite poor.

A business that is dependent on the owner will never reach full value potential because most of the value in the business is locked in the owner. Should the owner leave the business, they are likely taking customers and processes with them. Additionally, the brand and the owner have become synonymous, so if the owner exits, the value of the business decreases.

One of the easiest ways to build business value – and limit the amount of time you as an owner spend working outside of traditional work hours – is to decentralize yourself from the business.

Assemble Proof and Prepare Your Master Plan

Julie Keyes shares, “It’s important that the owner realize they can’t just sell their business without proper preparation and expect to get a high multiple.”

Rick Feltenberger states that the Value Acceleration Methodology allows him to determine his readiness and attractiveness. He says, “Our Value Acceleration Methodology process delivers an assessment of Attractiveness, Readiness, and Risk relative to our capacity for growth. If a business isn’t ready for growth, it isn’t ready for an exit. Value Acceleration Methodology has become the growth engine that will eventually take us to an exit.”

How Do I Incorporate This in My Company?

- Work through the Five Stages of Value Maturity

- Assess and mitigate risks in business before / as they arise

- Decentralize the Owner from business successes

Learn more about the Three Gates of the Value Acceleration Methodology in our whitepaper, “From Successful to Significant: The Framework for a High Value Business Transition.”

Share this

- Blog (547)

- CEPA (429)

- exit planning (249)

- CEPA community (188)

- Business Owner (173)

- Exit Planning Summit (99)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- women in business (19)

- Intangible Capital (18)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- Chris Snider (12)

- National Accounts (12)

- Small business (12)

- charitable intent (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- Owners Forum (3)

- author (3)

- forbes (3)

- DriveValue (2)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Annual Exit (1)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)