THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

What is the Value Acceleration Methodology™?

by Rob DiFranco on September 11, 2025

The journey to a successful exit involves more than preparing financial statements or setting a sale price; it is about building value now so the business is always ready for transition on the owner’s terms.

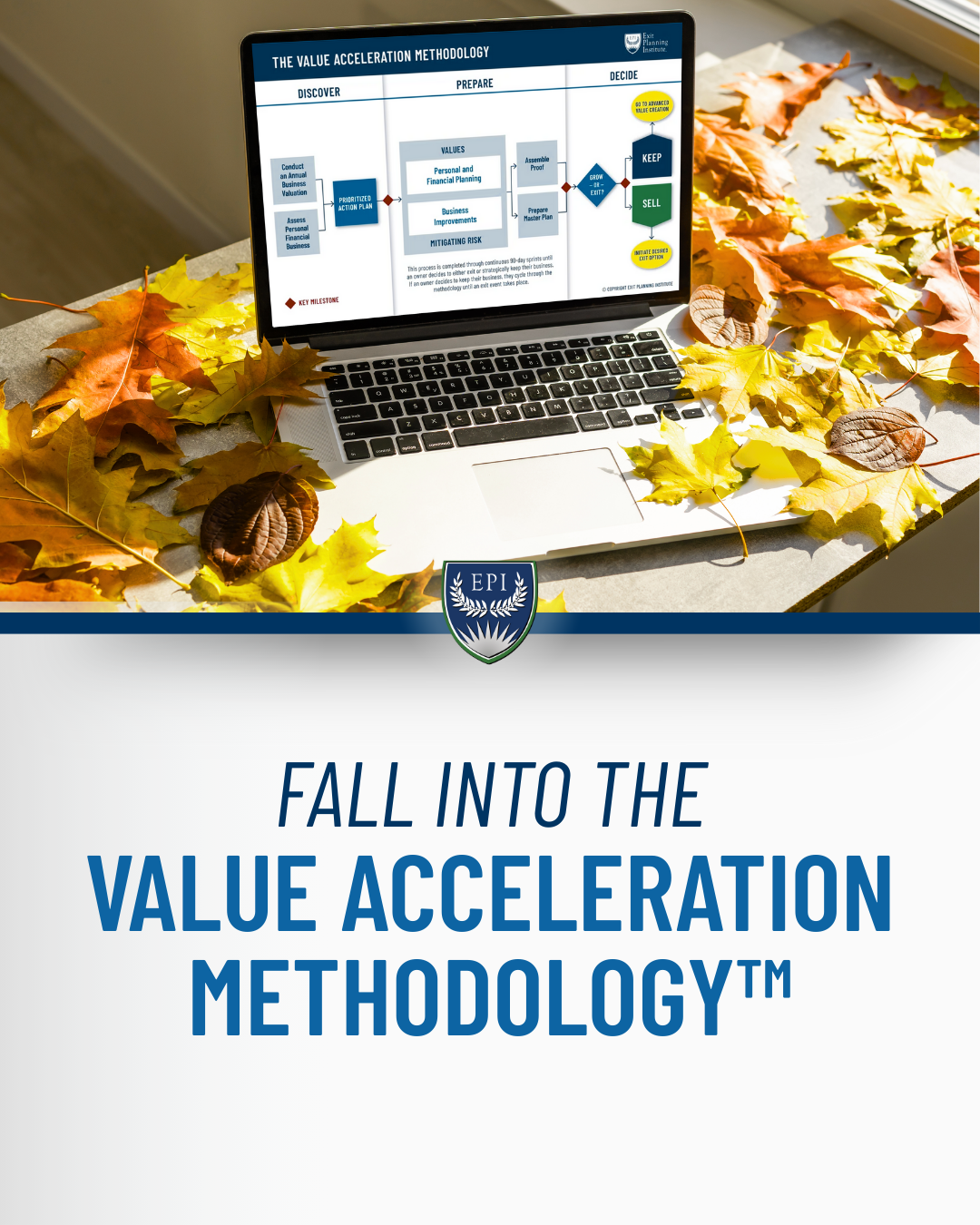

The Value Acceleration Methodology™ (VAM) is at the heart of what a Certified Exit Planning Advisor (CEPA®) does. It offers a strategic framework for growing value by combining business, personal, and financial goals into a proven process that helps owners unlock the wealth hidden in their business.

Owners and CEPAs utilize VAM to foster growth and ensure that every exit serves as a new beginning, not an end. Following VAM makes the difference between uncertainty and a successful new chapter in an owner’s life.

What is the Value Acceleration Methodology™?

Simply put, VAM is a proven process that focuses on value growth and aligns a business owner's business, personal, and financial goals. It helps an owner understand where they are currently, and where they need to be to make the most out of their business, often through a sale when used for the exit planning process.

As Christopher Snider, CEO of the Exit Planning Institute® (EPI), writes in Walking to Destiny: 11 Actions an Owner Must Take to Rapidly Grow Value and Unlock Wealth, “(VAM) is a management and life-planning system focused on value and income. It is grounded in action. It promotes team play for all stakeholders in an engaging process. It clarifies the road map to success.”

The roadmap Christopher mentions includes several important factors, including the Three Legs of the Stool, maximizing business value, personal financial planning, and life-after business planning, which play a crucial role in the Methodology. It also includes Three Gates (Discover, Prepare, Decide), paired with a set of deliverables, which help drive a CEPA and their client through the Methodology.

The Three Legs of the Stool

In the Three Legs of the Stool analogy, a business owner’s future after exit is (of course) a three-legged stool. If one of the legs is too short, the stool wobbles, leaving the owner unbalanced and dissatisfied after their exit.

That’s why aligning the Three Legs of the Stool is essential to creating a successful exit plan. Without all three legs aligned, a business owner risks becoming part of the 70% of owners who regretted selling their business within a year of the sale.

The Three Legs of the Stool are:

- The Personal Leg: This is often the most overlooked leg of the stool. It includes your health, family, friendships, community involvement, sense of identity, and how you’ll spend your time once you no longer run the business.

- The Financial Leg: This ensures that the wealth from the sale of the business translates into long-term security. It involves income requirements, retirement planning, investment strategy, and risk tolerance.

- The Business Leg: This is about building transferable value, ensuring the business can thrive without you. It includes leadership succession, systems, and intangible assets that drive future growth.

The Value Acceleration Methodology helps business owners and CEPAs ensure that each leg is developed in sync. By addressing personal, financial, and business goals together, owners build value and create a balanced plan for life after exit.

For a deep dive into the Three Gates and their deliverables, check out our Fall into VAM blog.

Why is VAM so Important?

To understand why the Value Acceleration Methodology is so essential to exit planning, it’s crucial to know how far exit planning has come over the last decade-plus.

As Christopher writes in Walking to Destiny, “Years ago, when I first got into this industry, it was taught that exit planning started in Gate Three: Decide. Walking to Destiny and the Value Acceleration Methodology moved that process back to Gate One: Discover. Its focus is not about the end. It’s about building a business that is always ready to grow or exit.”

Business owners achieve not just a successful exit, but also a significant one, when they harness the power of the Value Acceleration Methodology and work in tandem with their CEPA quarterback.

Mastering VAM

Interested in learning more about the Value Acceleration Methodology? Consider investing in the CEPA Program, which equips you with the knowledge and tools to implement the Value Acceleration Methodology into your practice.

Already have your CEPA Credential? EPI Academy offers several courses that dive deeper into the Value Acceleration Methodology, including The Basics of Value Acceleration, Implementing Value Acceleration as a Financial Advisor, Business Valuation Through the Value Acceleration Methodology, and more.

Another great option to hone your VAM skills is the annual Exit Planning Summit, where hundreds of exit planning professionals gather to network, share ideas, and get the latest exit planning strategies.

Related Resources

Share this

- Blog (548)

- CEPA (431)

- exit planning (249)

- CEPA community (188)

- Business Owner (175)

- Exit Planning Summit (99)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- women in business (19)

- Intangible Capital (18)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- charitable intent (13)

- Chris Snider (12)

- National Accounts (12)

- Small business (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- DriveValue (3)

- Owners Forum (3)

- author (3)

- forbes (3)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Annual Exit (1)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)