THE EXIT PLANNING BLOG

Keep up-to-date with exit planning, succession planning, industry trends, unique specialty insights, and useful content for professional advisors and business owners.

Share this

Closing the Value Gap: How CEPAs Should Support Clients by Setting Goals to Accelerate Value

by Exit Planning Institute on June 3, 2025

.png)

For business owners preparing for a successful exit, understanding the Value Gap — the difference between the current value of their business and the value they need for their exit — is crucial.

While recognizing this gap is important, the real challenge is how to close it effectively. This is where the power of setting growth-oriented goals comes in. As a CEPA, you know that your role is to help business owners create and execute strategic goals that align with closing this Value Gap. But what types of goals are the right ones to focus on, and which tools are the best for the job?

Let’s explore how CEPAs can help their clients set specific, actionable goals that drive value growth, increase profitability, and ultimately prepare them for a successful business transition.

Why Goal-Setting Matters in Closing the Value Gap

Goals provide a roadmap, ensuring that every action taken in an organization is moving the business closer to the desired outcome, and in the case of the Value Gap, closer to the desired value for exit. Without clear, measurable goals, it’s difficult for owners to know where to focus their efforts or how much progress they’re making toward closing the gap.

CEPAs have the unique ability to help clients set realistic, value-driven goals that align with both their personal exit objectives and their business’s long-term vision.

Types of Goals That Help Close the Value Gap

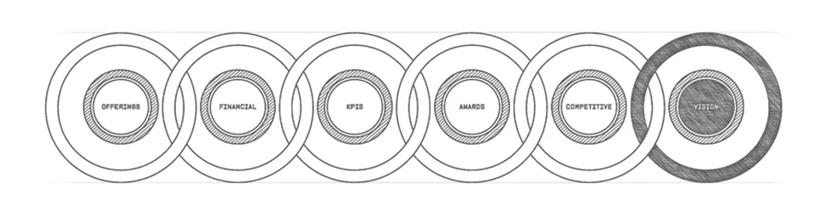

Goals can take many forms, each focusing on different aspects of the business that contribute to closing the Value Gap. Below are five key types of goals that can drive growth and enhance business value.

Financial Goals

Financial goals are perhaps the most direct way to impact the Value Gap. These goals focus on key financial metrics such as revenue, profit margins, and overall profitability. These goals help strengthen the company’s financial health, directly contributing to its value and making it more attractive to potential buyers or investors.

Examples of Financial Goals:

- Increase revenue by expanding into new markets

- Improve profit margins by reducing operational inefficiencies

- Achieve consistent year-over-year growth in EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

Key Performance Indicators (KPIs)

KPIs provide measurable benchmarks for tracking progress across various areas of the business. Common KPIs include paying customers, Net Promoter Score (NPS), and customer acquisition cost. By setting the right KPIs, advisors can help owners monitor key drivers of growth and profitability over time.

Examples of KPI Goals:

- Increase the number of paying customers by 15% in the next year

- Improve customer satisfaction by raising the NPS score to 70+ within six months

- Reduce customer acquisition costs by 10% over the next two quarters

Awards and Recognition Goals

Awards and recognitions are external validations of a company’s quality, culture, and performance (such as Great Place to Work or industry-specific awards) that can attract potential buyers or increase the company’s overall value. Advisors can help business owners set goals to earn these recognitions, which contribute to brand value and team member satisfaction — two very important factors for potential acquirers.

Examples of Awards Goals:

- Achieve Great Place to Work certifications by improving workplace culture and team member satisfaction

- Win an industry-specific innovation award for new product development

- Earn customer service awards to further validate the business’s market leadership

Competitive Goals

Competitive goals focus on increasing a business’s market share, improving its competitive position, or enhancing its unique selling proposition (USP). These goals could involve strategies to outperform key competitors, dominate a niche market, or introduce game-changing products or services.

Examples of Competitive Goals:

- Increase market share by 10% in the next two years by launching new offerings

- Outperform key competitors in customer satisfaction by improving service delivery

- Strengthen the business’s USP by developing proprietary technology or processes

Product and Service Offerings Goals

By setting goals to innovate or diversify offerings, business owners can tap into new revenue streams, meet emerging customer demands, and differentiate their business in the marketplace. These initiatives help grow revenue while simultaneously enhancing the business’s long-term viability.

Examples of Offering Goals:

- Launch two new product lines within the next 18 months

- Increase service offerings by integrating value-added services that complement core products

- Develop a subscription-based revenue model to ensure consistent cash flow

Vision: The Importance of Clear and Compelling Goals

While setting objectives is essential, creating clear and compelling goals greatly increases the likelihood of success. What’s better than just clear and compelling goals? Goals aligned with the business’s larger vision. Vision aligned goals provide a clear picture of what success looks like, define organizational priorities, and explain why leadership makes certain decisions.

Here’s how to ensure that every goal remains in lock-step with the company vision:

- Focus Teams: Unify individuals, teams, and departments across the business in working toward the same outcomes.

- Provide a Framework for Measuring Success: With clear goals, success is no longer ambiguous —it’s defined, measurable, and trackable.

- Celebrate Achievements: Well-constructed goals allow the company to celebrate successes along the way, boosting morale and keeping everyone motivated to continue working toward the final objective.

Get More Leverage for Value Acceleration

The Value Acceleration framework will empower your clients to master the art and science of setting, monitoring, and achieving goals. The next critical step to ensuring success is having a centralized system of record to drive insights.

A platform like Ninety is that system.

Ninety enables leaders, teams, and Advisors like you – acting as a client’s CEPA, CPA, or Attorney -- to be focused on the same outcomes. Everyone, fully aligned, is now positioned to thrive within their organization.

Within Ninety, teams are supported to set the SMART goals — Specific, Measurable, Achievable, Relevant, and Time-bound — that CEPAs map out, ensuring that business owners and their teams have a clear roadmap to follow. Each checkpoint reached along the journey provides a marker of progress and an opportunity to celebrate, building confidence and momentum as the business works to close its Value Gap.

These disciplines provide a clear, repeatable process for setting strategic goals at every level of the business — from the company-wide vision to individual team member objectives.

Take the Next Step: Setting Goals to Close the Value Gap

CEPAs have the unique ability to guide business owners through the process of closing the Value Gap by helping them set clear, compelling, and measurable goals. Whether the focus is on financial growth, market expansion, operational efficiency, or team member satisfaction, the right goals provide a path to increased business value and a successful exit.

By adopting a BOS and platform like Ninety, CEPAs can confidently know that each goal aligns with the business’s long-term vision and help their clients navigate the journey to a successful exit, one measurable milestone at a time.

Meet the Author: Tim Weerasiri

Related Resources:

Share this

- Blog (548)

- CEPA (431)

- exit planning (249)

- CEPA community (188)

- Business Owner (175)

- Exit Planning Summit (99)

- EPI Chapter Network (89)

- Value Acceleration Methodology (81)

- Exit Planning Partner Network (76)

- EPI Announcement (50)

- Content (48)

- Webinars (37)

- Excellence in Exit Planning Awards (34)

- Marketing (30)

- 2024 Exit Planning Summit (28)

- 5 Stages of Value Maturity (26)

- Books (24)

- EPI Academy (24)

- EPI Team (22)

- Exit Planning Teams (22)

- Leadership (21)

- 2023 Exit Planning Summit (20)

- family business (20)

- women in business (19)

- Intangible Capital (18)

- Exit Options (17)

- Black Friday (16)

- CPA (15)

- Walking to Destiny (15)

- Chapters (14)

- State of Owner Readiness (14)

- charitable intent (13)

- Chris Snider (12)

- National Accounts (12)

- Small business (12)

- personal planning (12)

- Financial Advisors (11)

- Season of Deals (9)

- 5 Ds (8)

- About us (8)

- Podcast (8)

- Scott Snider (8)

- Insiders Bash (7)

- Christmas (6)

- Exit Planning Content Library (6)

- Case Studies (5)

- Owner Roundtables (5)

- Three Legs of the Stool (5)

- Value Advisors (5)

- financial planning (5)

- Awards (4)

- Circle of Excellence (4)

- EPI Thought Leadership Council (4)

- Exit & Succession (4)

- Five Ds (4)

- executive training (4)

- DriveValue (3)

- Owners Forum (3)

- author (3)

- forbes (3)

- Exit Is Now Podcast (2)

- Peter Christman (2)

- Veteran (2)

- Whitepapers (2)

- Annual Exit (1)

- Business Owners Forum (1)

- SOOR (1)

- business consultants (1)